Growth Money Market Account

Saving smart starts here. Grow your money with a savings account that gives you flexibility and a competitive interest rate.

What is a money market account?

A money market account is a type of savings option that typically offers higher interest rates than a traditional savings account while keeping your money easily accessible.2 Unlike a Certificate of Deposit (CD), you’re not locked in, so you can withdraw money when you need it.Footnote 2 Enjoy secure savings growth and flexibility with limited check and debit card access - perfect for those looking to amplify their savings.Footnote 2

- $25

minimum opening deposit

- Competitive interest rates

up to % standard APY1 or higher APY with qualifying Relationship Checking account activities

- $10 or $0*

monthly maintenance fee

*Waived with a $5,000 minimum daily balance

Get a full breakdown of the account fees, terms and agreements

Rates that reward you

Maximizing your money is easy with our tiered interest rates - the more money you deposit, the higher your interest rate can be and the more you can earn.1

| Minimum balance to get APY1 | Standard APY1 | Amplify your APY1 |

|---|---|---|

| < $5,000 | % | % |

| $5,000 - $24,999.99 | % | % |

| $25,000 - $99,999.99 | % | % |

| $100,000 - $249,999.99 | % | % |

| $250,000 + | % | % |

Your rates are effective as of

How to amplify your APY

Have a BMO Relationship Checking account with your Growth Money Market account, and complete qualifying activities on your Relationship Checking account to earn a higher interest rate on your Growth Money Market account.Footnote 1

Explore our fees

Here are some fees you’ll want to know about.

| Feature | Fees |

|---|---|

| Monthly maintenance fee | $10 waived for 60 days after opening your new account or if you hold a minimum balance of $5,000Footnote 4 |

| BMO and Allpoint® ATM transactions in the U.S.Footnote 5 | FREE |

| Non-BMO ATM Transaction feeFootnote 6 | $3 |

| Transaction limitations | $15 for each additional transaction after your monthly limitFootnote 2 |

| Stop payment fee | $35 per request or renewal |

| Account closing fee | $50 if closed within 90 days of opening |

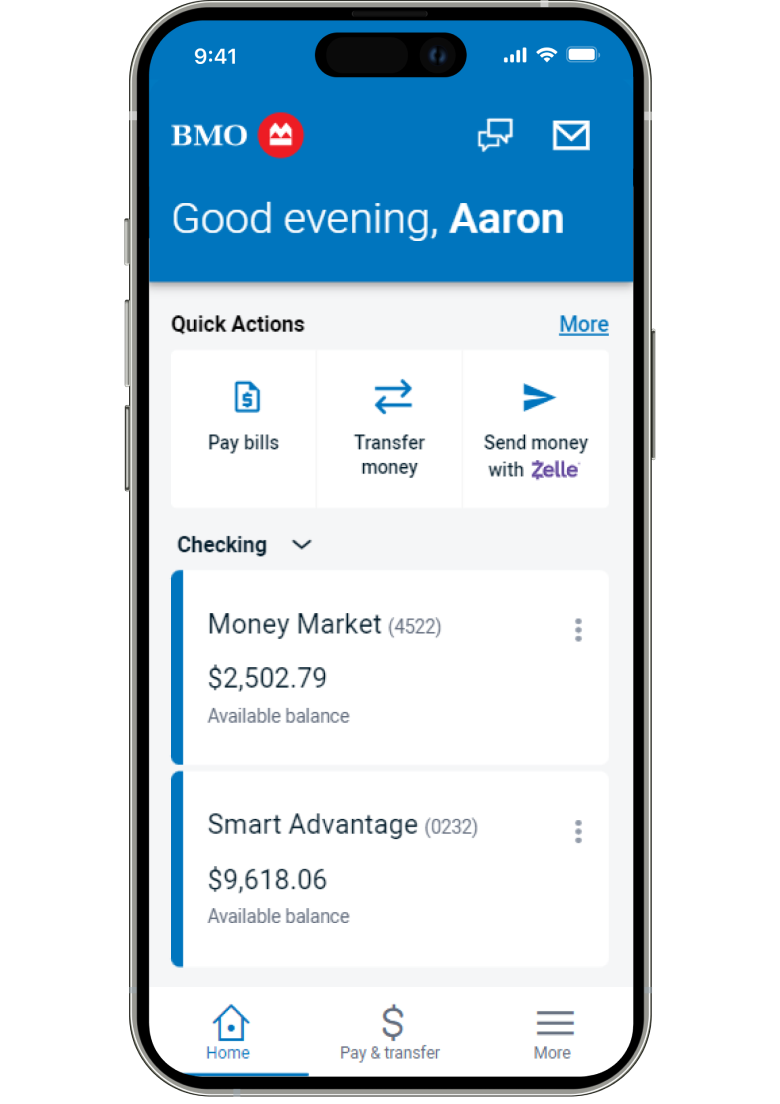

We make digital banking easy

Bank safely from anywhere with our simple online and mobile banking tools.Footnote 7

- Pay your bills on the go

Set up automatic payments, and schedule payments in advance.

- Transfer money between accounts

Move money between your personal accounts with BMO Digital Banking.Footnote 2

- Manage all your accounts in one place

Access all your accounts in one place, create budgets and track expenses with BMO Total Look.

- Deposit checks on your phone

Skip the bank trip and deposit checks using your smartphone.Footnote 8

Growth Money Market FAQs

A money market account is a type of savings account, and it functions in much the same way as other deposit accounts. You'll earn interest on the money that you save in your account. Plus, you get the flexibility to withdraw money from the account when you need to.Footnote 2

This will depend on how much money you deposit. Our Growth Money Market account offers competitive tiered interest rates; as your balance hits each tier balance, you then qualify for the interest rate associated with that tier. Plus, you can get an even higher interest rate when you pair your Growth Money Market account with a BMO Relationship Checking account that meets the qualifying activity requirement.Footnote 1

Yes, there’s a $10 monthly maintenance fee for the Growth Money Market account. We’ll waive this fee if your daily Ledger Balance (the amount of money in your account at the end of a Business Day) is $5,000 or more for the statement period.

You can open an account with as little as $25.

Yes, apply for an account online in less than 5 minutes.

Opening a new account is quick and easy. Yes, you can easily open an account online through our secureFootnote 7 application process. You can also visit a local branch or give us a call for assistance. All you’ll need is:

- Your phone number, email address and U.S. residential address

- Your date of birth and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- U.S. citizenship or status as U.S. Resident Alien

- If neither applies to you, don't worry - you can still apply for an account by visiting a branch or calling us at 1-888-340-2265

- Information to help you deposit money from your other bank, including one of the following:

- Your other bank's login credentials

- Your other bank’s routing and account numbers

Resources

Definitions of Capitalized Terms

Footnote 1 detailsThe Annual Percentage Yield (APY) is accurate as of . Growth Money Market is a variable rate account. Interest rates and APYs may change daily after the account is open. For accounts that have more than one tier, the interest rate corresponding to the highest tier into which the collected balance falls will be paid on the entire collected balance. At any time, interest rates and APYs offered within two or more consecutive tiers may be the same. In this case, multiple tiers will be shown as a single tier. The following collected balance tiers and corresponding standard APYs are effective as of the date shown and are subject to change at our discretion at any time: % for balances less than $5,000, % for balances between $5,000 and $24,999.99, % for balances between $25,000 and $99,999.99, % for balances between $100,000 and $249,999.99, and % for balances of $250,000 or more. We may offer higher interest rates when you are an Account Owner of both a BMO Relationship Checking account that has qualifying activities and a Growth Money Market account. Explore the Growth Money Market account disclosure for details. The following collected balance tiers and corresponding APYs for Account Owners with a BMO Relationship Checking account that has qualifying activities are effective as of the date shown and are subject to change at our discretion at any time: % for balances less than $5,000, % for balances between $5,000 and $24,999.99, % for balances between $25,000 and $99,999.99, % for balances between $100,000 and $249,999.99, and % for balances of $250,000 or more. Interest is calculated on the entire collected balance daily at the rate in effect for that balance tier. You must maintain the required minimum collected balance for each tier to earn the APYs disclosed. A periodic rate is applied on the collected balance in the account daily. Interest is compounded daily on the collected balance and credited to the account monthly on the statement period date. Checks you deposit into your account begin to earn interest on the Business Day we receive credit for them. Fees and withdrawals may reduce earnings. For account and fee information or current interest rates, visit bmo.com or call 1-800-546-6101.

Footnote 2 detailsExplore transaction limitations.

Footnote 3 detailsPlease visit the FDIC website for current deposit insurance limits.

Footnote 4 detailsIf your daily Ledger Balance is $5,000 or more for the statement period, we'll waive the $10 monthly maintenance fee.

Footnote 5 detailsForeign Transaction Fees will apply at BMO and Allpoint® ATMs located outside of the United States.

Footnote 1 detailsA Non-BMO ATM Transaction is any transaction conducted at a Non-BMO ATM, including, for example, a withdrawal, transfer, or balance inquiry. We charge this fee for each Non-BMO ATM Transaction, except for a balance inquiry. The ATM owner or operator may also charge you a surcharge fee for a withdrawal, transfer, or balance inquiry.

Footnote 7 detailsVisit the BMO Security Center for details.

Footnote 8 detailsMessage and data rates may apply. Contact your wireless carrier for details. Mobile Deposit is available using the BMO Digital Banking app. This service may not function on older devices. Users must be a BMO Digital Banking customer with a BMO account opened for more than 5 calendar days. Deposits are not immediately available for withdrawal. For details, explore the BMO Digital Banking Agreement found at bmo.com/en-us/legal