Get the most out of your business expenses

Choose a BMO business credit card that offers BMO Rewards or cashback to make your money go even further.

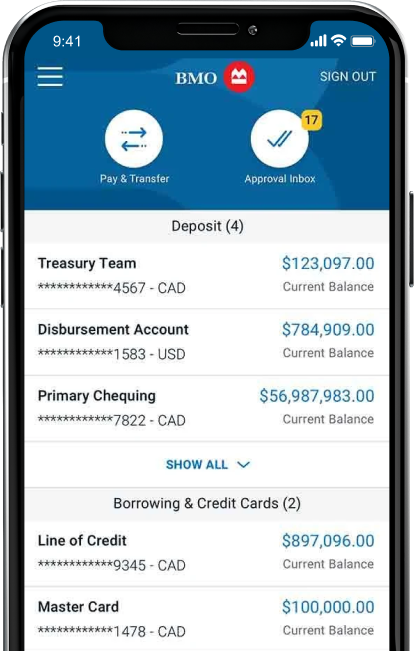

Online Banking for Business

Customize your banking experience to fit your unique needs, preferences and goals. And as your business evolves, our services evolve right along with you.

A better way to bank

Online Banking for Business makes it easy to:

Move money your way

Whether you’re managing payroll, collecting payments or sending money overseas, you’ll have a variety of flexible options at your fingertips.

Manage your users

Keep your business running smoothly with flexible user management tools. Assign limits, set approvals, and segregate duties across your team.

Stay ahead of the curve

Take advantage of an ever-growing suite of payment technologies, open banking APIs and integrations with the business apps you use most.

Get expert advice

Your BMO advisor is always on hand with industry-leading guidance and solutions tailored to fit your business.

Flexible options tailored for your business

Online Banking for Business FAQs

Online Banking for Business is for any size of business that would benefit from multiple user roles, payment approvals and other account controls, cross-border banking, or that has more complex payment and reporting needs in general. You can compare online banking options for your business here.

- Because we customize Online Banking for Business to fit your business’ unique needs, preference and goals, fees are determined by the level of service your business requires. Compare Online Banking for Business with our no-fee online banking option here.

Online Banking for Business works with a variety of deposit and borrowing accounts including Canadian and U.S. currency accounts, foreign currency accounts, corporate credit card accounts, commercial mortgages and more.

Online Banking for Business has many options for sending and receiving domestic and international payments, including Interac e-Transfers, wire payments, and Electronic Fund Transfers. You can set up and manage payroll, tax and bill payments, recurring payments and more.

Customized user settings are a key component of Online Banking for Business. You can create as many users as you require and assign them custom access levels, 2-step verification requirements and transaction limits. You can also customize payment approvals for each payment service on both a company-wide and a per user level.

Online Banking for Business makes it easy to create customized reports on-demand and download them in different file formats. Get cash flow, account, and user activity reports as well as detailed reports from your specific payment services.

Online Banking for Business has many integration options, including APIs and connections to popular accounting and other business apps. Contact a BMO business banking professional for more details.