What is a bank account?

A bank account is a financial tool that allows you to store and access your money. There are two main types of bank accounts: checking accounts, which are usually used as daily transactional accounts, and savings accounts, which are usually used to keep aside money you don’t plan on using every day.

Explore our checking accounts

No monthly maintenance fee, no minimum balance footnote 1

Unlimited transactions at 40,000+ ATMs nationwide

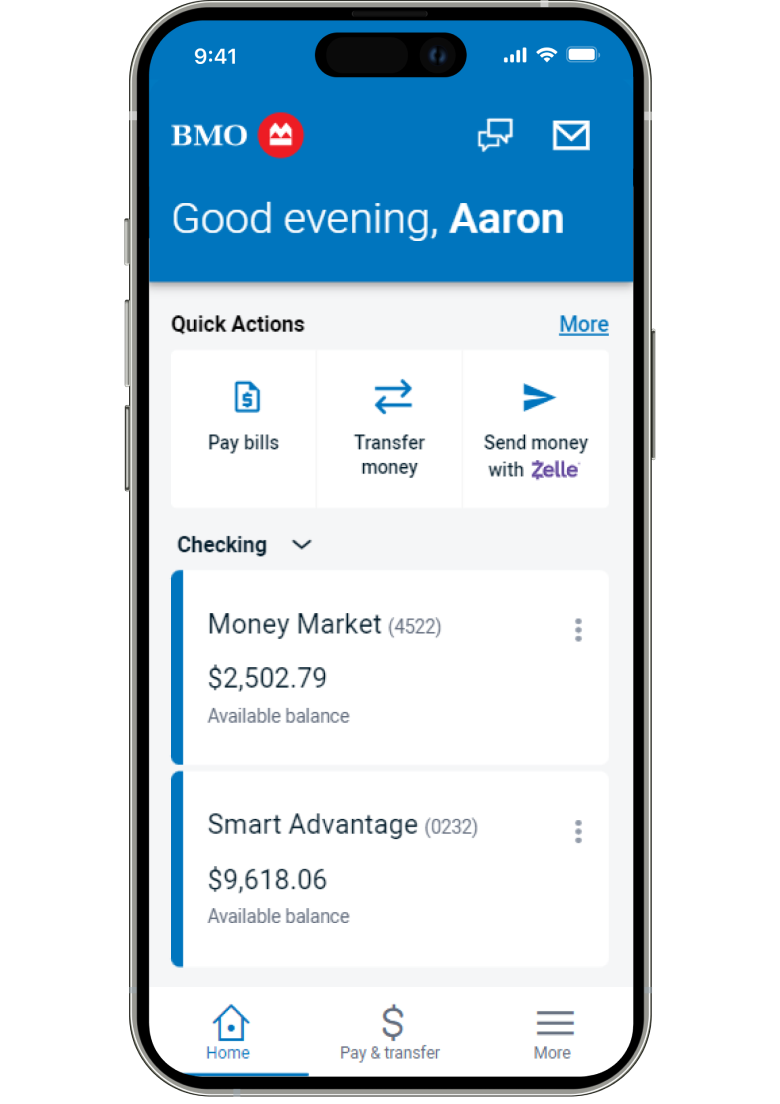

Banking at your fingertips with BMO Digital Banking footnote 2 – pay your bills, transfer money and more

Personalized support through online chat, phone and in branch

Open online in 5 minutes!

$5 monthly maintenance fee$0 if you’re under age 25

$0 overdraft fees footnote 3

Unlimited transactions at 40,000+ ATMs nationwide

Banking at your fingertips with BMO Digital Banking footnote 2 – pay your bills, transfer money and more

Personalized support through online chat, phone and in branch

Open online in 5 minutes!

$25 monthly maintenance feeor waive this fee - learn how

Relationship Packages that offer more benefits the more you bank with BMO

4 Unlimited Non-BMO ATM Transactions footnote 5 and monthly surcharge fee rebates

Access to Mastercard ID Theft Protection® on your BMO Debit Mastercard® footnote 6

Interest on your checking balance

Explore our savings accounts

No monthly maintenance fee so your money goes farther

Get an extra $5 every month you grow your balance by $200 or more for the first year footnote 7

Get easy access to your savings

Get our best rate with access footnote 8 to your funds!

$10 monthly maintenance fee, waived with a $5,000 minimum daily balance

Earn a higher interest rate on your Growth Money Market account when you also have a BMO Relationship Checking account with qualifying activities footnote 9

Get convenient access footnote 8 to your funds with competitive rates

Park your savings at a higher rate!

No monthly maintenance fee

Competitive rates and your choice of terms

Feel secure knowing your CD interest rate is locked in for your term

Security however you bank footnote 11

Whether you bank via mobile footnote 2, online or telephone, all your banking methods are convenient and secure. footnote 11 Our Financial Crimes Unit combines expertise from cyber security, fraud, physical security, and crisis management teams. We work to detect, prevent, respond to, and recover from security threats.

We make banking easy

Manage all your banking needs, whenever and wherever you like. Bank from anywhere with our simple online and mobile footnote 2 tools or find a no-fee ATM close to you.

- Over 40,000+ fee-free ATMs across the U.S

Enjoy unlimited fee-free transactions at over 40,000 BMO and Allpoint® ATMs nationwide. footnote 12

- Transfer money from anywhere, the fast way

Send, request and receive money from friends and family with Zelle®. footnote 13

- Account protection for added peace of mind

Bank with confidence knowing your deposits are FDIC insured and you’re protected by our Digital Banking Agreement. footnote 14

- Save time and simplify your financial life

Use our no-fee money management tool, BMO Total Look, to explore all your financial products – even if they’re not with us – in one secure location.

Bank account FAQs

Yes, at BMO, you are free to open multiple bank accounts to suit your various financial needs. You may decide to have a combination of checking accounts, savings accounts, and even money market accounts or certificates of deposit; having separate accounts can help you manage your finances better.

Yes, you can access your BMO account online. All you need to do is enroll in BMO Digital Banking, then log into your account on your computer or mobile device2. For added convenience, you can also download the BMO Digital Banking app once you’re enrolled2.

Switching to a BMO bank account from another financial institution is simple and only takes three steps. You can also update your direct deposit to your new checking account with just a few clicks during the account opening process. To make things even easier, BMO offers a bank switch kit that's free to download.

Yes, BMO bank accounts are FDIC-insured, providing security for your deposits. Please visit www.fdic.gov for current FDIC insurance limits.

You can easily open an account online through our secure11 application process. You can also visit a local branch or give us a call for assistance.

All you'll need is:

- Your phone number, email address, and U.S. residential address

- Your date of birth and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- U.S. citizenship or status as U.S. Resident Alien

- If neither applies to you, don't worry - you can still apply for an account by visiting a branch or calling us at 1-888-340-2265

- Information to help you deposit money from your other bank, including one of the following

- Your other bank's login credentials

- Your other bank's routing and account numbers

- Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

- Mastercard, Mastercard ID Theft Protection® and the circles design are registered trademarks of Mastercard International Incorporated.

- Footnote 1 detailsAccounts with zero balance may be closed.

- Footnote 2 detailsMessage and data rates may apply. Contact your wireless carrier for details.

- Footnote 3 detailsItems that overdraw the account are returned and ATM/everyday debit card transactions are declined.

- Footnote 4 detailsTo access the benefits in a particular Relationship Package, you must have a BMO Relationship Checking account. Go to the Deposit Account Disclosure for details.

- Footnote 5 detailsA Non-BMO ATM Transaction is any transaction conducted at a Non-BMO ATM, including, for example, a withdrawal, transfer, or balance inquiry. No BMO fee; however, the ATM owner or operator may charge you a surcharge fee for a withdrawal, transfer, or balance inquiry.

- Footnote 6 detailsCertain terms, conditions, and exclusions apply. For complete coverage terms and conditions call 1-800-MASTERCARD (1-800-627-8372) for assistance. Refer to the Mastercard Guide to Benefits for more information.

- Footnote 7 detailsFor every month your Savings Builder account balance grows by at least $200, we will credit the account with a $5 savings reward within 5 calendar days after the end of the month. To calculate if your balance has grown by $200, we will compare the Ledger Balance on the last Business Day of the previous month to the Ledger Balance on the last Business Day of the current month. Interest and savings reward payments will not count towards your balance growth. Tip: Deposits made on weekends and holidays will not be processed until the next business day. To ensure your deposit is counted for the current month, avoid scheduling your recurring transfer or deposits towards the end of the month.

- Your account is eligible for 12 savings rewards beginning with the month your account is opened. The first savings reward is based on your savings growth from the Business Day the account is opened through the last Business Day of that month. If your initial deposit is not received until the month after account opening, the account will only be eligible for 11 savings rewards.

- Your account must be open when the savings rewards are paid. Savings rewards will be reported to the IRS for tax purposes and you are responsible for any applicable taxes. Exclusions:

- Savings rewards are available for new accounts only. An account switched into Savings Builder from a different product is not eligible for savings rewards.

- Savings rewards are limited to one Savings Builder account per customer as Primary Account Owner. Only your first account opened is eligible for savings rewards.

- You are not eligible to receive savings rewards if you have previously opened a Savings account between February 3, 2020 and October 18, 2021 and participated in the Business Savings account – Savings Rewards offer.

- Footnote 8 detailsExplore transaction limitations.

- Footnote 9 detailsGrowth Money Market is a variable rate account. We may offer higher interest rates when you are an Account Owner of both a BMO Relationship Checking account that has qualifying activities and a Growth Money Market account. Explore the Growth Money Market account disclosure for details. For account and fee information or current interest rates, visit bmo.com or call 1-800-546-6101.

- Footnote 10 details Early withdrawal penalties may apply. Annual Percentage Yields (APYs) are accurate as of the date stated and are subject to change at any time. For current rate information, contact your banker or call us at 1-800-546-6101. To receive these APYs, you must open your account online, by phone at 1-888-340-2265, or at a branch. CDs opened online can only be in individual or joint ownership and cannot be for an IRA. For CDs opened online, funds may not be withdrawn for 15 calendar days after funding. For CDs opened by phone, accounts must be funded within 10 business days of application, and funds may not be withdrawn for 15 calendar days after funding. Please visit the FDIC website for current FDIC insurance limits.

- Footnote 11 detailsVisit the BMO Security Center or details.

- Footnote 12 detailsForeign Transaction Fees will apply at BMO and Allpoint® ATMs located outside of the United States.

- Footnote 13 detailsU.S. checking or savings account required to use Zelle®. At BMO we require you enroll a checking account to use Zelle®. Transactions between enrolled users typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle®. Zelle® should only be used to send money to people and businesses you trust. Zelle® does not offer protection for authorized payments, so money you send may not be recoverable. For details, explore the BMO Digital Banking Agreement found at bmo.com/en-us/legal.

- Footnote 14 detailsCertain conditions and limitations apply. The Digital Banking Guarantee applies to personal accounts only. Please visit the BMO Digital Banking Agreement found at bmo.com/en-us/legal for details.