Get a consolidated view of your BMO and non-BMO financial information with a personalized command center.

Make real financial progress with our simple solution that helps you establish, strengthen, and grow your credit.footnote 1

Visit a branch near you to apply for the BMO Boost Secured Credit Card.

A secured credit card functions similarly to a traditional credit card, with the main difference that it is secured by funds in a deposit account. This acts as collateral for your credit card.

This is a great option for those looking to build or rebuild their credit. By using your secured card responsibly and making regular payments, you can establish a positive credit history. Over time, this can help improve your credit score and potentially open up more opportunities for even better financial options.

Your card offers a wide range of benefits, from cellphone protection to reliable travel assistance.

Get coverage for any unauthorized purchases.

Receive up to $400 in coverage when using your BMO Boost Secured Credit Card to pay your monthly cell phone bill.

Access benefits designed to assist you or your travel companions when you’re traveling 50 miles or more from home.

Annual FeeFootnote star

$25

Standard purchase APRFootnote star

25.49%,variable rate

Balance transfer APRFootnote star

25.49%,variable rate

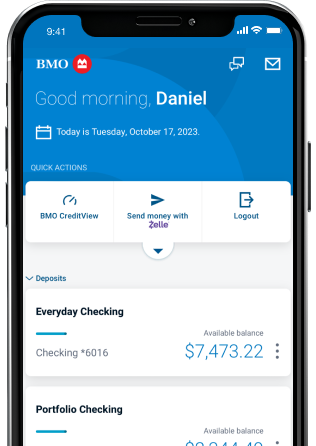

Check your balance, pay your bills and track your spending all in one place and make the most of your credit card by taking advantage of special features and money management tools.

Get a consolidated view of your BMO and non-BMO financial information with a personalized command center.

Manage all your banking in one app.

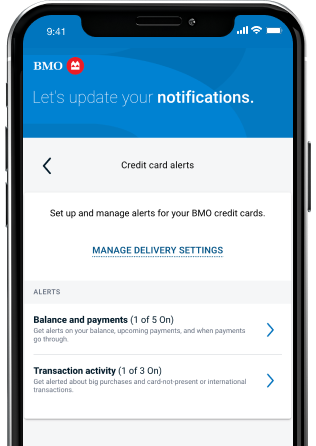

Track spending, receive real-time updates, and manage your card with custom alerts and notifications — all in one place.

Once you've received your card, just give us a call to activate it.

If you have a BMO Platinum Credit Card, a BMO Platinum Rewards Credit Card, BMO Boost Secured Credit Card or a BMO Cash Back Credit Card, call 1-855-825-9237.

If you have a BMO Premium Rewards Credit Card or a BMO Escape Credit Card call 1-855-825-9238.

The main difference between the two types of cards is that secured credit card is secured by funds in a deposit account. This acts as collateral for your credit card.

With a secured card, you’ll need to put down a deposit that will act as collateral. If approved for the BMO Boost Secured Credit Card, your savings account deposit secures your credit card account in an amount equal to the credit limit on your credit card. It’s also ideal if you’re looking to build or rebuild your credit. For an unsecured card, an initial savings account deposit is not required to secure the credit limit.

When it comes to secured credit cards, security interest serves as collateral.

Payments on a secured credit card work just like any other credit card. You will receive a monthly statement outlining your purchases and the minimum payment due. By making on-time payments each month, you will build a payment history that can help boost your credit. With BMO Digital Banking, you can keep your account current by enrolling in Autopay to automatically make your payments on-time each month.

Can’t find your card? No worries, we’ve got you covered.

If you’ve misplaced your card or suspect that it’s been stolen, just let us know. Visit the Lost and Stolen Credit Card Page to learn more.

Footnote 1 detailsImpact on your credit may vary. On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score.

Footnote 2 detailsMinimum opening deposit must be at least equal to the credit limit on your BMO Boost Secured Credit Card. Account will be pledged, and a hold will be placed on your savings account, to secure your Secured Credit Card in an amount equal to the approved credit limit. Funds deposited in excess of the amount of the hold will be available for withdrawal in accordance with the terms of the Deposit Account Agreement for Personal and Business Accounts.

Footnote 3 detailsCreditView and its features, Score Simulator and Credit Education, are provided by TransUnion® for educational purposes only. You should consult with your own financial team for more information about credit score.

Footnote 4 detailsPay only for purchases that you have authorized on your Mastercard card. Unauthorized purchases are not your responsibility. Conditions and exceptions apply. Learn more: http://www.mastercard.us/zero-liability.html.

Footnote 5 detailsCoverage provided under a group insurance policy issued by New Hampshire Insurance Company, an AIG company. Policy provides secondary coverage only. Coverage for a stolen or damaged eligible cellular wireless telephone is subject to terms, conditions, exclusions, and limits of liability of this benefit. The maximum liability is $400 per claim for BMO Boost Secured Credit Card, and $600 per covered card per 12-month period. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per covered card per 12-month period. The monthly bill associated with the phone must be paid with the eligible card for coverage to be effective. Refer to the Mastercard Guide to Benefits for more information.

Footnote 6 detailsSee the Guide to Benefits at bmo.com/en-us/pdf/credit/consumermcgtb.pdf for full program details.

Footnote 7 detailsCertain terms, conditions, and exclusions apply. Extended Warranty and MasterRental® are underwritten by New Hampshire Insurance Company, an AIG company. For complete coverage terms and conditions call 1-800-MASTERCARD (1-800-627-8372) for assistance. Refer to the Guide to Benefits at bmo.com/en-us/pdf/credit/consumermcgtb.pdf for more information.

Footnote star detailsAccess Summary of Credit Terms for rate and fee information.

Apple and Apple Pay® are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Pay are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks of Samsung Electronics Co., Ltd

Mastercard, MasterRental, Tap & Go and MasterTrip are registered trademarks of Mastercard International Incorporated.

Accounts are subject to approval and are provided in the United States by BMO Bank N.A. Member FDIC.