BMO PaySmart™ Installment Plans

A new way to pay smarter

A BMO PaySmart Plan can make things more manageable now by turning your credit card purchases into equal monthly paymentsFootnote 1. Whether it’s for an appliance upgrade, a much-needed home repair or an unexpected purchase, buy it now with the confidence that you’ll pay it off by a set date.

Not signed up for BMO Digital Banking yet? REGISTER NOW

Let’s do this! What do I need to know before I set up my installment plan?

You’re the primary cardholder or coborrower of an eligible BMO credit card that’s in good standing and not in default

You’re registered for BMO Digital Banking

You have a recent eligible Purchase of $100 or more on your BMO credit cardFootnote 1

Want to learn more about Buy Now Pay Later and how it works? Explore our in-depth guide.

Your BMO PaySmart Plan playlist

BMO PaySmart Credit Card Installment Plan FAQs

A BMO PaySmart Plan lets you split eligible purchases into fixed monthly payments over a set time frame of your choosing. This feature is available as part of your existing credit card Account and doesn’t require a credit application. When you create a PaySmart Plan you don't pay interest, just a fixed monthly fee based on the amount of the transaction and the duration of the plan which will be disclosed when the plan is created. The Monthly Plan Payment will become part of your Minimum Payment Due each month.

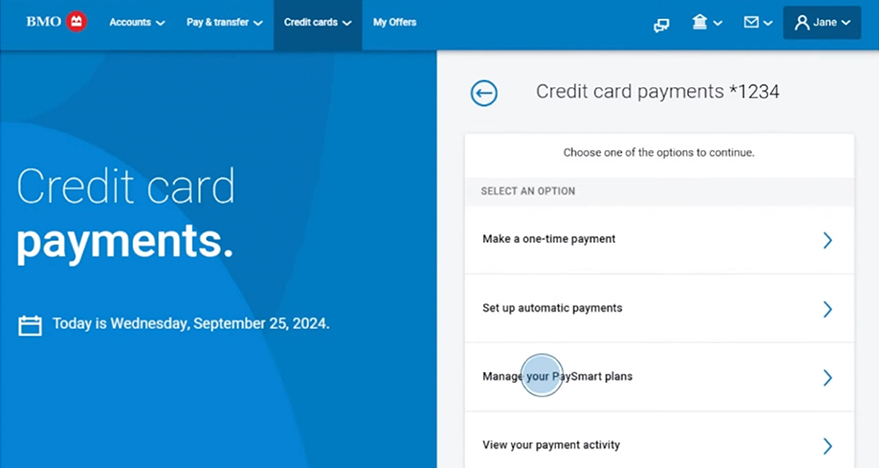

- Log in to BMO Digital Banking and select your eligible credit card Account from the Account summary page.

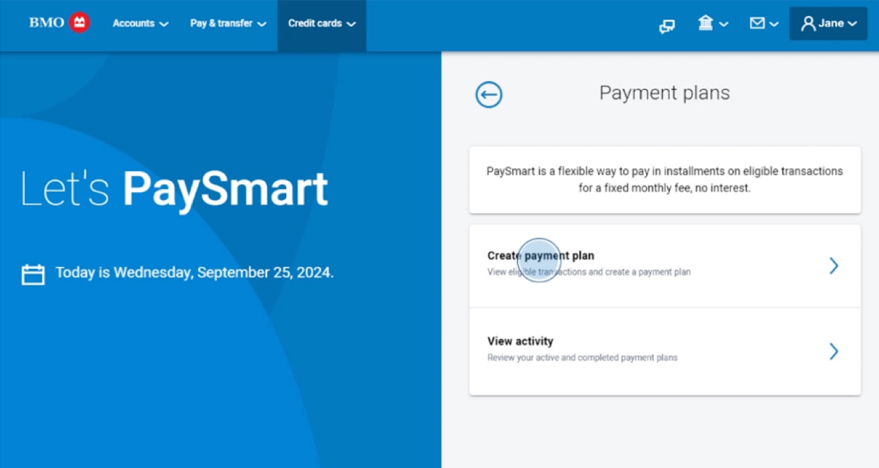

- From the Account details page, you can select the “PaySmart” button and then “Create plan” or choose an eligible purchase from your recent transaction activity.

- After selecting an eligible purchase you would like to convert to a PaySmart Plan, you will choose an installment plan with a 3, 6, or 12 month duration. Each plan includes details on the Monthly Plan Payment and fee amount as well as the total payment amount.

- The last step includes reviewing and agreeing to the Terms & Conditions of your plan by clicking on the “Confirm” button.

It will take up to two business days to become active. Plan details will be shown under the “Active plans” tab in BMO Digital Banking

Yes. You can have several active installment plans at the same time and there is a limit of 10 plans that you can have active at any given time.

You can cancel your plan at any time through BMO Digital Banking by following these steps:

- Log into BMO Digital Banking and select your eligible credit card Account from the Account Summary page.

- From the Account Details page, you can select the “PaySmart” button and then “View activity”.

- Under “Active plans”, choose the plan you want to cancel.

- Select “CANCEL THIS PLAN”.

Your plan will usually be cancelled within two business days. If you cancel your plan, any remaining balance will be added to your credit card balance and be subject to your standard Purchase Rate as of the cancellation date.

You will not be charged any cancellation fees or any monthly plan fees that have not yet been billed. Please note that once you cancel a plan, the remaining balance will not be eligible for any future PaySmart Plans.

How does having an installment plan on my credit card Account affect my Available Credit?

Installment plans are based on the original purchase posted to your credit card Account. The amount of that purchase has already reduced your Available Credit. Enrolling the eligible purchase into an installment plan does not change your Available Credit.

Will having a BMO PaySmart Plan affect my credit score?

An installment plan won’t impact your credit score as long as you pay your monthly Minimum Payment Due on time. When you set up an installment plan, BMO will not perform an additional credit check.

What are the fees on a BMO PaySmart Plan?

You’ll be shown a monthly installment plan fee of up to 1.0% of your original Purchase amount depending on the duration of the plan. We’ll let you know what your Monthly Plan Fee is during setup.

Do I still earn rewards if I set up an installment plan?

Yes. If your BMO credit card Account earns rewards on Purchases, you will earn rewards on the amount of the original Purchase that you convert to an installment plan, in the same way that you do on any other Purchase made on your Account (for example, points or cash back).

Explore the BMO Rewards Rules for more information on how you earn rewards on your BMO credit card Account.

What happens to my BMO PaySmart Plan if I close my credit card?

We will not cancel any active installment plan(s) on your credit card Account if you close your credit card Account. You can cancel your plan any time through BMO Digital Banking or by calling the number on the back of your card.

Visit our BMO Paysmart Installment Plan FAQs if you have additional questions.