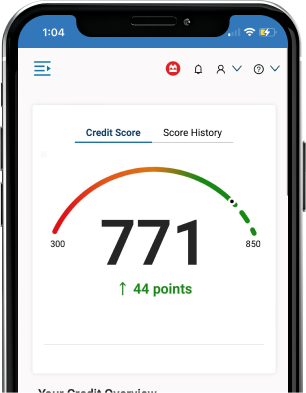

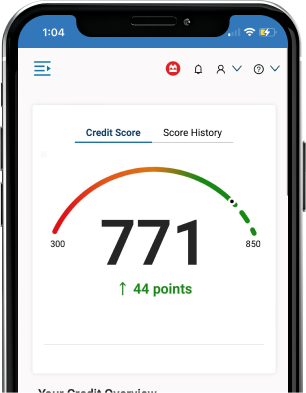

Check your score

Get a snapshot of your most up-to-date credit score.

A good credit score can help you save more whether it’s getting better interest rates on home loans or higher credit limits on accounts. We’ve teamed up with TransUnion® to give you BMO CreditView, where you can get no-fee, no-impact access to your credit score so you can start monitoring and learn steps to build your credit today.

A credit score is a three-digit number that reflects your ability to pay loans, bills, and other commitments on time. It also helps lenders make approval decisions on items such as rental properties or issuing a credit card or a loan.

*Based on the TransUnion® credit score range, 5/2023.

Watch this short demo to understand how BMO CreditView can:

And much more!

Here are some factors that affect your credit score:

1. Pay all your bills on time

By paying your amount owed on time and consistently, your credit score may steadily rise. An easy way to pay bills is by setting up automated payments, at your bank or directly with the biller, so you never miss a payment.

2. Apply for different types of credit

Getting a mortgage, applying for a line of credit or personal loan, if managed responsibly, may be individual opportunities that may allow your credit score to rise.

3. Check your credit report for any errors

You should view your full credit report so that there are no errors. You can view your full credit report by using BMO CreditView.

4. Pay credit card payments on time

It's important that you make on-time payments on your credit card as this may have a positive impact on your credit score.

Access your credit score with BMO CreditView on the BMO Digital Banking appfootnote star star

Start banking anytime, anywhere and get access to helpful digital tools.

Get a snapshot of your most up-to-date credit score.

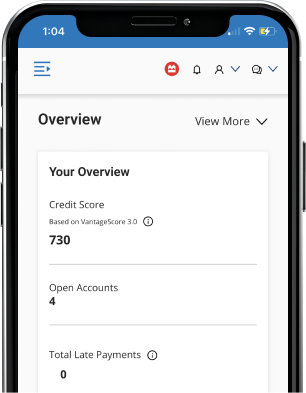

Access a detailed report of your borrowing activity in the United States, including active payments, payment history and any inquiries on your account.

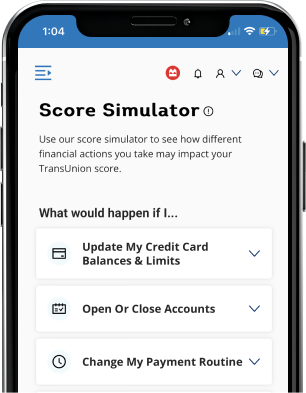

Want to pay off a balance or get another credit card? Use the TransUnion ScoreSimulator® to see how your credit score may be affected.

Your credit score plays a big part in your financial health and now you can get it quickly and for free. We’ve teamed up with TransUnion to give you access to CreditView®, where you can get your free credit score, plus find tips from TransUnion on how you can improve it.

No, it will not impact your credit score.

Please note the “Next update available” date on the CreditView® dashboard. This date will show the next time your credit information will be updated.

If you have any questions about your credit benefits, need help accessing your report or passing identity verification, please contact TransUnion Customer Service at 1 8 5 5 9 4 6 5 7 5 5.

If you have a dispute with a BMO account, please reach out to BMO at 1 8 8 8 3 4 0 2 2 6 5.

Please follow these steps to cancel your CreditView® service:

Your credit score can seem like a mystery. We’ll help you understand how it works.

We’ll help explain the loan application process, so you’ll know what to expect.

A home equity line of credit may help you put all your debt in one place and pay it off.

CreditView and its features, Score Simulator and Credit Education, are provided by TransUnion for educational purposes only. You should consult with your own financial team for more information about current credit score.

CreditView is a trademark of TransUnion LLC.

*Participation in BMO Flex Rewards is subject to terms and conditions found in BMO Flex Rewards Program Rules, available at: bmo.com/bmoflexrewardsconsumer . The Account must be current and in good standing to accrue and redeem points or cash back, as applicable. While points and cash back don’t expire, if the Account is closed for any reason, the Account will no longer be able to accrue points or cash back. All accrued points or cash back not redeemed will be available for redemption for 90 days as long as the Account is closed in good standing. All cash back is redeemable in the form of a statement credit.

footnote star star detailsMessage and data rates may apply. Contact your wireless carrier for details.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Google Play is a trademark of Google Inc.