Create your savings goal

Set up your goal in minutes and start contributing right away.

With BMO Savings Goals, you can set up, track, and reach your goals... Now that’s progress!

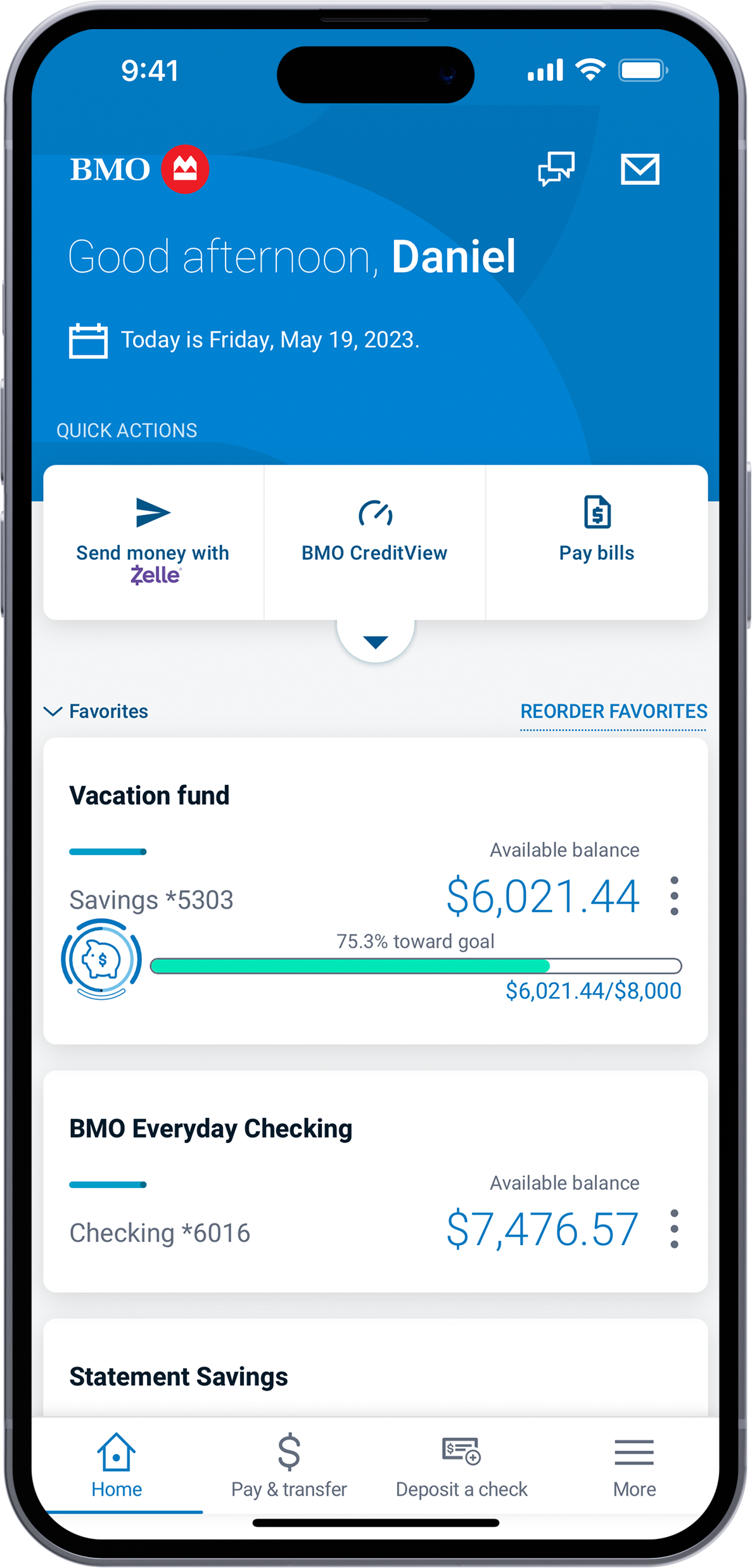

Manage your savings goals on the go*

Set up your goal in minutes and start contributing right away.

Track the progress of your goal and your savings contributions.

Edit your goal and adjust your recurring transfer to meet your goal.

Open a savings account today and find out how BMO Savings Goals can help you make real financial progress.

A Savings Goal is a way to save and track your progress for things that matter to you. We want to help you make real financial progress toward your goals.

A Savings Goal is available through BMO Digital Banking for customers who have a personal savings or business savings account.

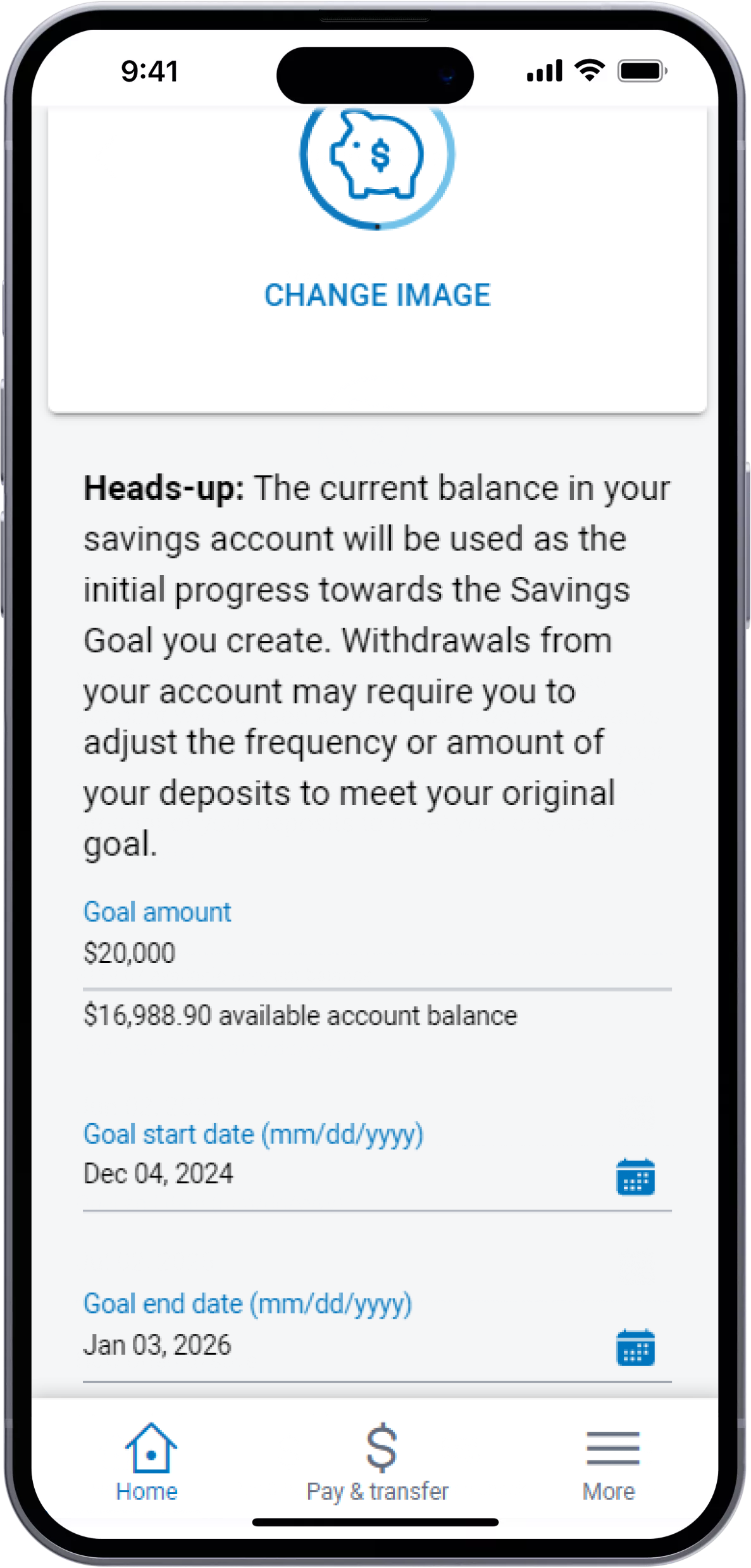

If you have a personal savings or a business savings account, you can log in to BMO Digital Banking and go to the Account Details page, then select START A SAVINGS GOAL to create your personalized Savings Goal.

Once you create a Savings Goal in the Account Details page of the savings account, you will see a VIEW SAVINGS GOAL link underneath the progress bar. This link takes you to your Savings Goal details page.

Once you have created a Savings Goal, a progress bar will appear on the Account Summary page in BMO Digital Banking.

How do I add funds to my savings account to progress toward my Savings Goal?

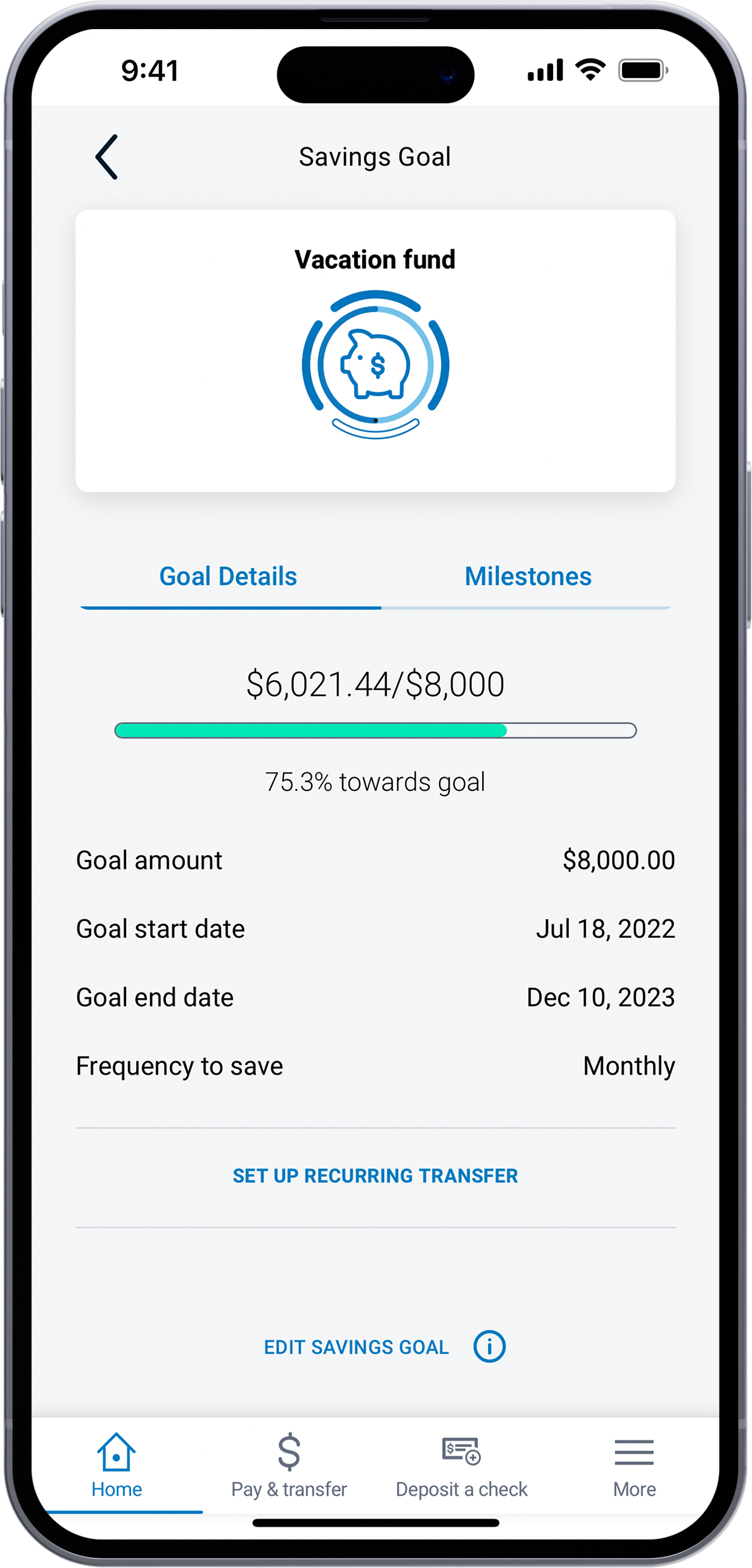

On the Savings Goal details page, the ADD FUNDS button allows you to transfer funds from other eligible BMO accounts to your savings account.

Remember, any deposit to your savings account, recurring or one-time, will add to the balance of your account and savings goal. This means that you can deposit a check, transfer funds from a BMO account or an account at another financial institution, and deposit money via a BMO ATM or at a branch. However you choose to add funds will count toward the progress of your goal.

Can I set up a recurring transfer to my savings/business savings account?

Once you create your goal, and if you have an eligible BMO account, you will be prompted to set up a recurring transfer to help you achieve your goal. You may set that up right away or in the future. If you choose to set up a recurring transfer later, you can go to the Savings Goal details page and select the SET UP RECURRING TRANSFER link to create a new recurring transfer to your savings account. If you need to edit your recurring transfer you can use the MANAGE RECURRING TRANSFERS link to edit an existing recurring transfer to your savings account.

For additional information on recurring transfers please refer to the Internal Transfers section on this FAQ page.

How do I change/delete my Savings Goal?

On the Savings Goal details page the EDIT SAVINGS GOAL link allows you to completely change your goal or make small adjustments. If you want to, you can also delete your goal. Do this any time you'd like, it's your goal. Deleting a Savings Goal has no impact to your savings account or its balance.

Can I have more than one Savings Goal?

Yes. Only one goal can be created per savings account. If you wish to set up multiple savings goals, you can open a new Savings Builder account online or by calling 1-888-340-2265. You can find more information on opening a Savings Builder account on our Savings Builder page. To open a new Business Savings Builder account, please visit a branch or call 1-888-340-2265.

What happens when I get to 100% of my goal?

When your goal progress bar reaches 100%, you have achieved your goal – congratulations! Once you have achieved your goal, the next step is up to you. You can use the funds for the goal you created, or you can edit your goal to increase the goal amount, change the name to a new goal and/or extend the duration of your goal, or you can delete the goal. No matter what you do it’s your goal!

What happens to my recurring transfer when I reach 100% of my goal?

If you reach your goal prior to your goal end date, that transfer will continue to move money to your savings account until your goal end date. You can cancel the remaining transfers by going into the Savings Goal details page and selecting MANAGE RECURRING TRANSFERS to edit or delete.

If you’re new to budgeting, the whole process can seem overwhelming. Discover how the 50/30/20 budgeting method can help you take control of your finances, quickly and easily.

Are you worried about saving money? You're not alone: more than 40% of Americans are worried about their savings. Here's how to stop spending and start saving.

An emergency fund can help you get through tough financial times. Get tips on starting an emergency fund and how much you should save.

Check out our demos for step-by-step guidance.