BMO InvestorLine adviceDirect

An investing platform that combines online investing with personalized advice and support. Start investing today with a minimum balance of $10,000.

Start with 15 trades annually and unlock more as your balance grows.

Unlimited trades† for portfolios with total assets of $1 million and higher

Identify new investment opportunities with exclusive access to buy & sell recommendations

24/7 portfolio monitoring & dedicated advisor support at your fingertips

Personalized trading advice, real-time alerts, and ESG insights

Special Offer:

Get up to $10,000 cash back with BMO InvestorLine footnote star

What BMO InvestorLine adviceDirect costs

BMO InvestorLine adviceDirect offers you all the benefits of an online investing platform with personalized investment advice and dedicated advisor support at a fraction of the cost. With an all-inclusive annual fee, you will be eligible to receive 15 trades annually (unlock more as your balance grows, with unlimited trades† for portfolios greater than $1 million), valuable trade recommendations, tools, and research.

- 0.50%: For assets < $1MM

- 0.30%: For assets between $1MM < $5M

- 0.10%: For assets $5MM+

The more assets you have, the lower your fee.

Note: A minimum balance of $10,000 is required to open an account. All fees are calculated on an annual basis.

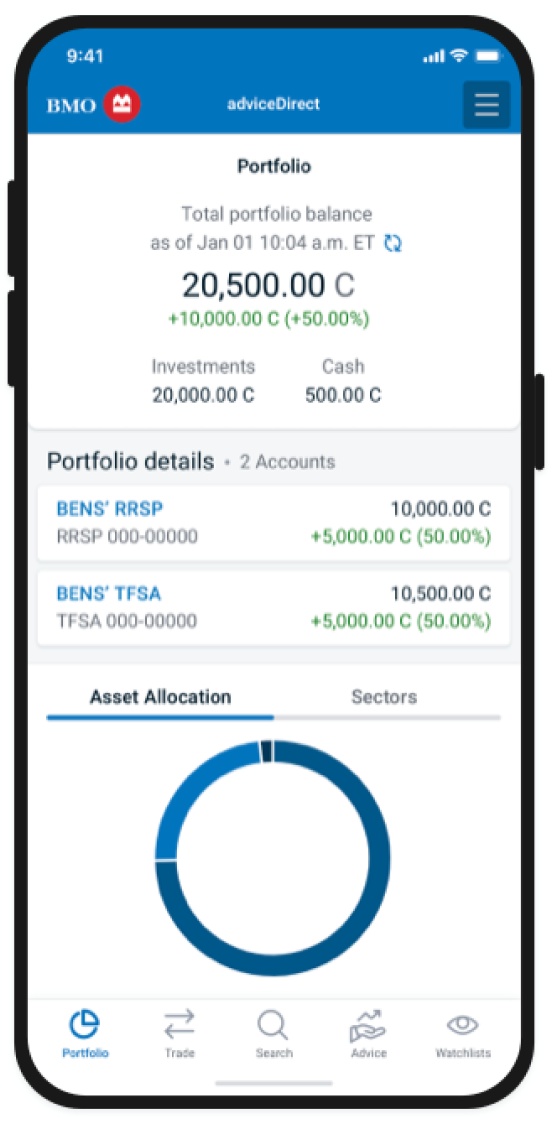

Invest on the go with the new BMO Invest App

Easy access to online investing with personalized advice, buy/sell recommendations, 24/7 portfolio monitoring for smarter investing decisions

Monitor your investments using the MyAdvice tool based on asset allocation, diversification, ratings, and risk

Log-in to your adviceDirect account on the move and start trading now

Note: The BMO Invest app is designed for mobile phones. For the best BMO InvestorLine experience on tablets please use the latest version of your web browser. Supported browsers include Chrome, Edge, Firefox and Safari.

Compare your adviceDirect options

Find your match, based on your investment preferences. Choose an adviceDirect account or opt for more personalized financial planning with adviceDirect Premium. Wondering if adviceDirect is right for you? Open a free adviceDirect Preview account to sample some of its functionalities.

adviceDirect PreviewSample adviceDirect for free No funding required | adviceDirectTrade online with expert advice $10,000 minimum account size | adviceDirect PremiumadviceDirect + dedicated advisor and financial planning $500,000 minimum account size | |

|---|---|---|---|

Research and securities ratings | available with(Limited functionality) | available | available |

Trade ideas | available with(Limited functionality) | available | available |

Watchlists | available with(Limited functionality) | available | available |

Portfolio evaluation | available with(Limited functionality) | available with(MyAdvice) | available with(MyAdvice) |

Online Trading | not available | available | available |

Get 15 trades annually and unlock more footnote dagger | not available | available | available |

Trade recommendations & data-driven insights | not available | available | available |

Environmental, Social, and Governance ratings and analysis | not available | available | available |

Personalized advice with adviceDirect advisors | not available | available | available |

Dedicated one-to-one adviceDirect advisor relationship | not available | not available | available |

Access to financial planning | not available | not available | available |

Accounts available with adviceDirect

These accounts are registered with the federal government and offer you certain tax incentives. Registered accounts can help with retirement investing, saving for education or a large purchase, and more.

Great for: Investing in the future while getting tax incentives.

Non-registered accounts don’t offer any tax advantages. They do not have any limits to your contributions, however, so you’re free to contribute and withdraw as much as you want.

Great for: Saving for a large purchase like a down payment.

Accounts offered: Individual, Joint, Cash, Margin

Do you have a pension and are leaving your company? A locked-in account allows you to hold your money once you’ve left, and keep it in the account until you’re ready to enjoy your retirement.

Great for: Investors with a pension.

Accounts offered: Locked in Retirement Account, Locked in Retirement Savings Plan, Registered Locked in Savings Plan, Life Registered Income Fund, Locked in Retirement Fund, Prescribed Retirement Income Fund, Restricted Life Income Fund

A corporate or non-personal account is a type of non-registered account that is set up in the name of a business or other entity.

Great for: Investing on the behalf of another individual, a business, or an association.

Accounts offered: Trusts, estates, associations, corporations, investment clubs or partnerships, personal holding companies.

Investment types available with adviceDirect

Stocks are easily tradeable units of ownership in a publicly traded company. Get access to stock trading on the major North American exchanges, including the Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE) and NASDAQ.

Exchange traded funds (ETFs) are a combination of equities, fixed income and other assets. They can be traded just like stocks, and come with typically low management fees.

Canadian Depositary Receipts allow investors to invest in global companies that are listed on foreign exchanges. CDRs are listed on a Canadian exchange and priced in Canadian dollars.

A mutual fund pools your money with other investors to buy a portfolio of investments overseen by a portfolio manager. They are easy to purchase with low investment amounts.

A guaranteed investment certificate (GIC) is a secure investment that guarantee 100% of your principal, meaning your initial investment is safe, no matter what the market does.

Bonds are fixed-income contracts that function like loan agreements between investors and borrowers.

InvestorLine adviceDirect frequently asked questions

adviceDirect is for you if you want investment advice and want to make your own final decisions. It might not be for you if you're an active trader, day trader or you use other frequent trading strategies.

To open an adviceDirect account, you'll need a minimum deposit of $10,000. Your initial balance can be a deposit, transfer, or a combination of both. Several accounts can be linked, but one of those accounts must have a minimum of $10,000 in total billable assets.

Should the account size drop below $10,000 because of market fluctuations, you won't be penalized. However, the account will be reviewed and you may be asked to close your adviceDirect account if the account drops below the minimum for other reasons such as, withdrawals or transfers.

You can open the following types of accounts with adviceDirect: Cash, Margin, Retirement Savings Plan, Registered Education Savings Plan, Tax Free Savings Account, Registered Retirement Income Fund, Prescribed Retirement Income Fund, Registered Locked in Savings Plan, Life Registered Income Fund, Locked in Retirement Fund, Restricted Life Income Fund and Locked in Retirement Account.

Get started any of the following ways:

- Complete an online application.

- Call us at 1-888-776-6886 between 8 a.m. and 6 p.m. (ET), Monday to Friday.Call us at 1 8 8 8 7 7 6 6 8 8 6 between 8 a.m. and 6 p.m. (ET), Monday to Friday.

- Drop in to any BMO Bank of Montreal branch.

- Download and print an application, fill it in and drop it off at a BMO Bank of Montreal branch or mail it to:

- BMO InvestorLine adviceDirectTransit #3973First Canadian Place100 King St. W., Floor B1Toronto, ON M5X 1H3

You must submit an Authorization to Transfer form. By signing into your account, select Move Money from the top menu bar, our site will guide you on whether your transfer request is eligible for electronic submission or if a manual form is required.

Our team does all the research. Your recommendations are based on fundamental analysis from investment research leaders MarketGrader and Morningstar, for over 6,100 stocks, 3,000 mutual funds and 900 ETFs. You even get a preview of the impact on your portfolio before you trade.

Visit our FAQ page.