Explore our student banking offers

Get great rates on our products for post-secondary students.

Earn a $175 cash bonus* when you open a new BMO Student Chequing Account.

Features

Enjoy no monthly Plan fees*73 and save $215.40 per year** with a Performance Plan

Limited time offer: Receive a promo interest rate of up to , guaranteed for up to 120 days when you add a Savings Amplifier Account*

Keep your student account benefits for up to 12 months after you graduate*65,*78

Get unlimited transactions and Interac e-Transfer®§ transactions

Get the first accidental fee charged on your new student savings and chequing accounts reversed footnote section

Get complimentary access to OnGuard® with the Performance Plan – saving you more than $150 a year!*74

Need more benefits? Compare our student bank plans

Welcome offer: Get up to 5% cash back in your first three months with a Student BMO CashBack® Mastercard®* – that’s up to $125 in cash back*.

Limited time offer: Open a BMO Student Line of Credit and earn a $200 footnote star or $500 footnote star cash bonus, depending on your program of study.

Features

Enjoy no annual or monthly fees

Get competitive interest rates

Make interest-only monthly payments while you’re in school and for two years after you graduatestar star star

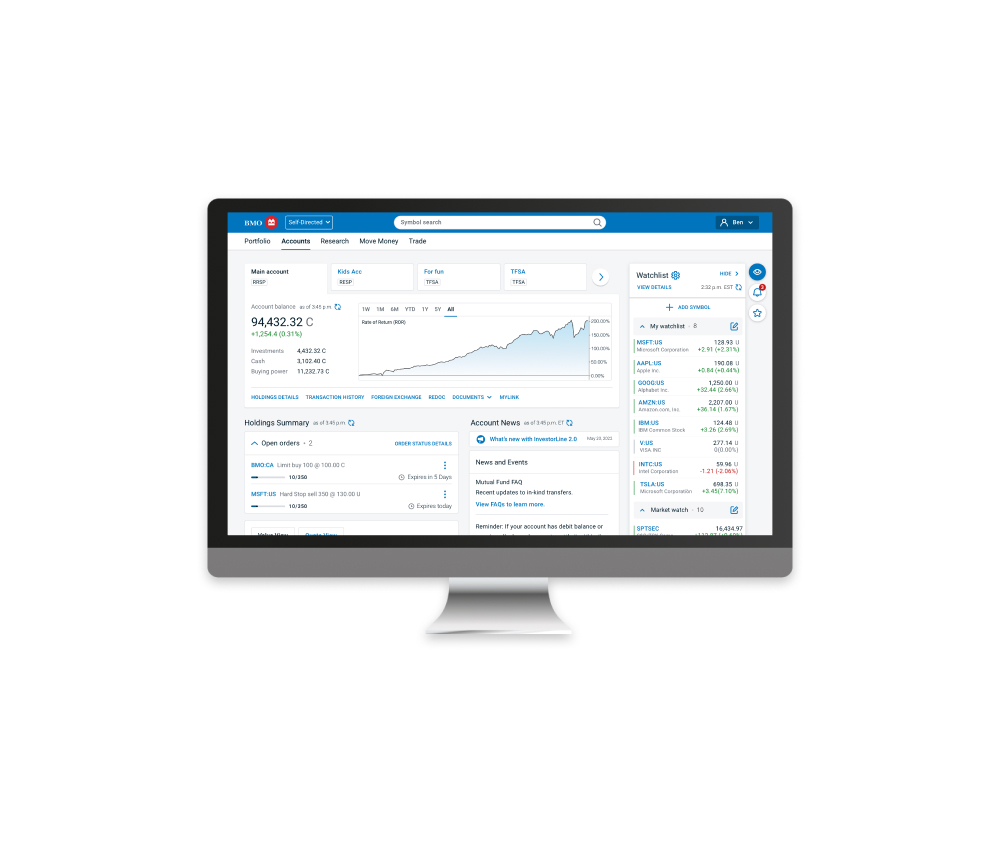

Try BMO InvestorLine Self-Directedstar

Tips and tools for student life

Explore our student banking resources.

Try our student budget calculator

Use our interactive calculator to build a budget so you’re prepared to manage your finances while in school.

Follow BMO NXT LVL on Twitch

Join our Gaming Relations Specialist, Sean Frame, for livestreamed games and financial advice.

Understand your credit score

Want to learn about what a credit score is and how to improve it? We can help.

Send and receive money easily

Students who bank at BMO get unlimited transactions, including Interac e-Transfer®§ transactions.

Use our cashflow worksheet

Tally up your income and expenses to get a clear idea of where your money’s going.

Find a branch near home or campus

Get help making financial decisions at your nearest BMO branch.

Easy, secure digital banking

Reviews have been edited for spelling and punctuation.

Career opportunities for students and graduates

Whether you’re just starting your studies, or you’ve almost completed your degree, we’re here to help you make real progress toward your goals.

Interested in working at BMO? Check out our available internships and co-op opportunities.

Starting to think about your career? Explore job opportunities with BMO.

Student banking FAQs

If you’re enrolled in a professional education program, like accounting or optometry, you can access special rates and offers. Other professional student programs include:

- Chiropractic

- Law

- MBA

- Pharmacy

- Veterinary Medicine

Learn more about professional student offers.

A line of credit is actually a type of loan that functions like something between a debit and credit card. The line of credit lets you withdraw money up until a certain limit, and use that money on whatever you need – books, tuition, rent, and even groceries. The best part? You only pay interest on what you borrow. To help figure out your budget for the school year, try the student budget calculator.

Student loans tend to be given out federally (although banks can too!) and when paying off your loan you will pay interest on the entire amount borrowed.

A student bank account is a bank account intended for use by students enrolled in a post-secondary educational program.

With a student bank account, you get unlimited transactions, including unlimited Interac e-Transferfootnote registered section transactions.

Investing in a Registered Education Savings Plan (RESP) generates tax sheltered earnings for your child’s education, housing and other expenses. The earlier you start, the more time your money has to grow. Learn more about RESPs.

Yes! You can easily open a BMO student bank account online in about 7 minutes.

You can keep the same account, but some fees may apply if you’re no longer a student. You can continue enjoying student banking for up to 12 months after you graduate, just pop into your closest branch before November 30 of the year you graduate and provide proof of graduation – saving you another $215.40 on Plan fees.star seventy three

If you don’t update your status, regular Plan fees will apply starting in December.

You’ll need a Canadian address, Social Insurance Number (SIN) and proof of full-time enrolment in a post-secondary institution. You can open a student bank account online or at your nearest branch.

Yes, when you open a student chequing account, you will receive a debit card linked to that account.

The benefits of a student bank account include no monthly Plan fees*73, unlimited transactions and more. These benefits are available while you’re in school and for up to 12 months after you graduate.

To find more information on financial literacy, you can check out our informative articles on this page. We also have a wide range of financial education resources available for you at BMO Smart ProgressTM.

Explore our resources for student banking

How to study in Canada: An international student’s guide

Canada offers many opportunities for international students to get a great education at an even greater value. Find out how to study abroad in Canada.

How to start investing as a post-secondary student

Learn how investing early can really pay off towards investing success in the long run, along with practical steps you can take now.

A guide to finding the best student bank account

You may have already budgeted for most of your new expenses, but it can be tough to get the balance right. Here’s how to use banking to your advantage.

Footnote star details Terms and conditions apply. Open to view full offer details.

Footnote star, star details The Savings of $215.40 is calculated for the Performance Plan Monthly Fee of $17.95 per month for 12 months. Students at a full-time university, college or registered private vocational school are eligible to receive the Performance Plan with no monthly Plan fee or receive a discount equivalent to the Performance Plan fee from the Premium Plan fee.

star star star details Interest only payments include up to two years of Specialty studies for a BMO Dental Professional Student Line of Credit and a maximum of seven years of residency for a BMO Medical Student Line of Credit.

registered details Footnote dagger details OnGuard is a registered trademark of Sigma Loyalty Group Inc.

registered star details Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Used under license.

registered section details INTERAC e-Transfer is a registered trademark of Interac Corp. Used under license

section details With Easy First Fee Reversal, we’ll reverse the first accidental fee incurred on your new student account. Eligible fees for Easy First Fee Reversal on a Chequing or Savings account include: A non-sufficient funds fee, an overdraft fee, and a fee for transactions when you go over your monthly plan limit. To access this one-time only fee reversal, call us or visit us in branch.