Options Trading with BMO InvestorLine Self-Directed

Elevate your investment strategy with our comprehensive options trading tools and resources.

Begin your journey with a simple, easy-to-use platform.

Boost your knowledge with in-depth learning resources.

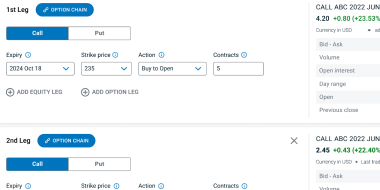

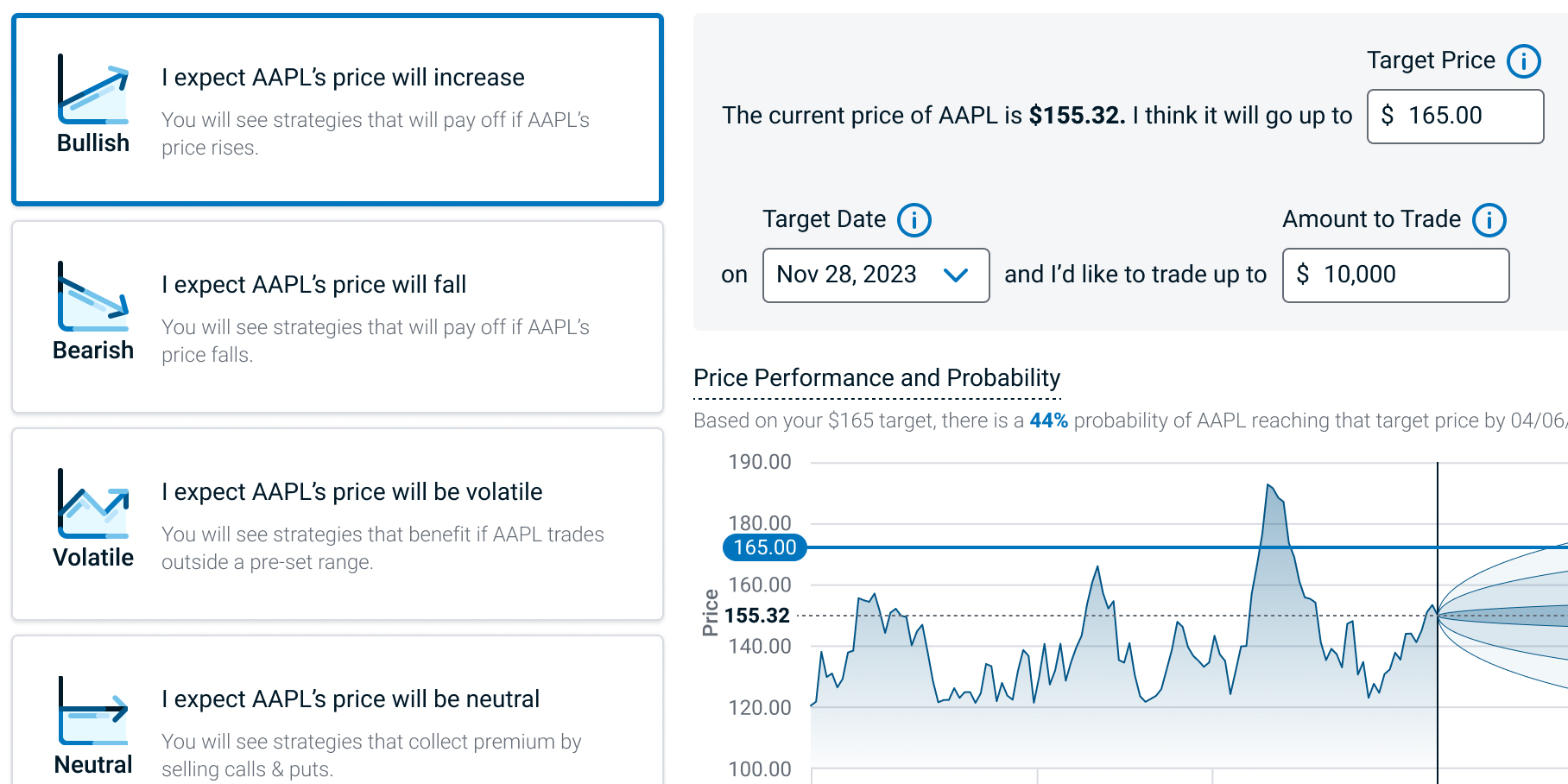

Use advanced tools and capabilities like multi-leg options, screeners, strategy builders with margin trades evaluated using real time buying power calculations.

Understanding Options Trading

Options provide flexibility and control, allowing you to speculate on market movements or hedge against uncertainties in your portfolio.

|

|

Get started with BMO InvestorLine Self-Directed

Confidently trade options, stocks, ETFs and more with comprehensive research and tools designed to simplify your investment journey.

Leverage advanced trading features and dedicated support.

Access industry leading research and real-time quotes.

Make informed decisions with personalized performance tracking and insights.

Experienced trader? Elevate your trading with BMO InvestorLine’s 5-Star Program

Tailored for seasoned traders, our program offers exclusive tools, options trading, and dedicated support for those with 15+ trades per quarter or over $250,000 in investments.

Get dedicated support with exclusive pricing.

Superior tools and analysis for better-informed decision-making.

Free access to BMO Active Trader – our most powerful online trading platform yet.

Related Resources

FAQs

Options trading differs from traditional stock trading as it involves buying contracts that grant you the right to buy or sell stocks at a predetermined price by a specific date. Unlike owning shares directly through stock trading, options trading offers strategic flexibility as it requires less initial capital. However, it does carry unique complexities and risks.

The potential for losses in options trading can surpass the initial investment, especially with certain strategies. It’s important for traders to thoroughly understand both the mechanics and risks involved with options, including the possibility of losing the entire premium paid for the options contract.

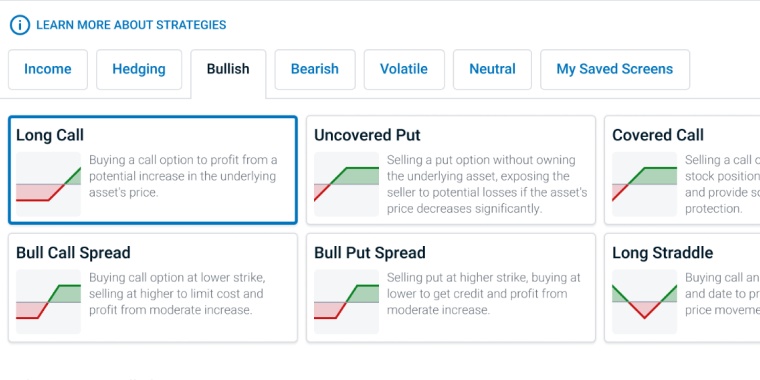

Popular strategies include:

- Buying calls or puts for speculation or hedging

- Selling covered calls for potential income generation

- Bull and bear spreads for speculation

Each strategy has unique goals and risk profiles that are suitable for different market conditions and investor objectives.

Yes, options can be traded on various assets including stocks, ETFs and indexes. This allows investors to trade options strategies across a diverse range of investment opportunities.

Some common mistakes in options trading include:

- Not understanding the specific terms of an options contract

- Ignoring the impact of time decay on premium prices

- Failing to manage risk adequately

You’ll need an options-approved account. If you’re a new client, you can apply for an options-approved account when opening your BMO InvestorLine account. If you’re an existing client, you can upgrade your account online.

Options trades are subject to commissions. For detailed information on fees and commissions, please refer to our Commission and Fee Schedule.

Our Education Hub is packed with resources like articles, videos, webinars, and courses on options trading. We cater to traders of all levels, from beginners to seasoned professionals. Visit our Education Hub today!