Online trading tools and research

A great online trading platform needs to go beyond just point-and-click trading. InvestorLine gives you the benefits of industry leading research, expert analysis and advanced investment tools to help you invest with confidence, no matter your level of experience.

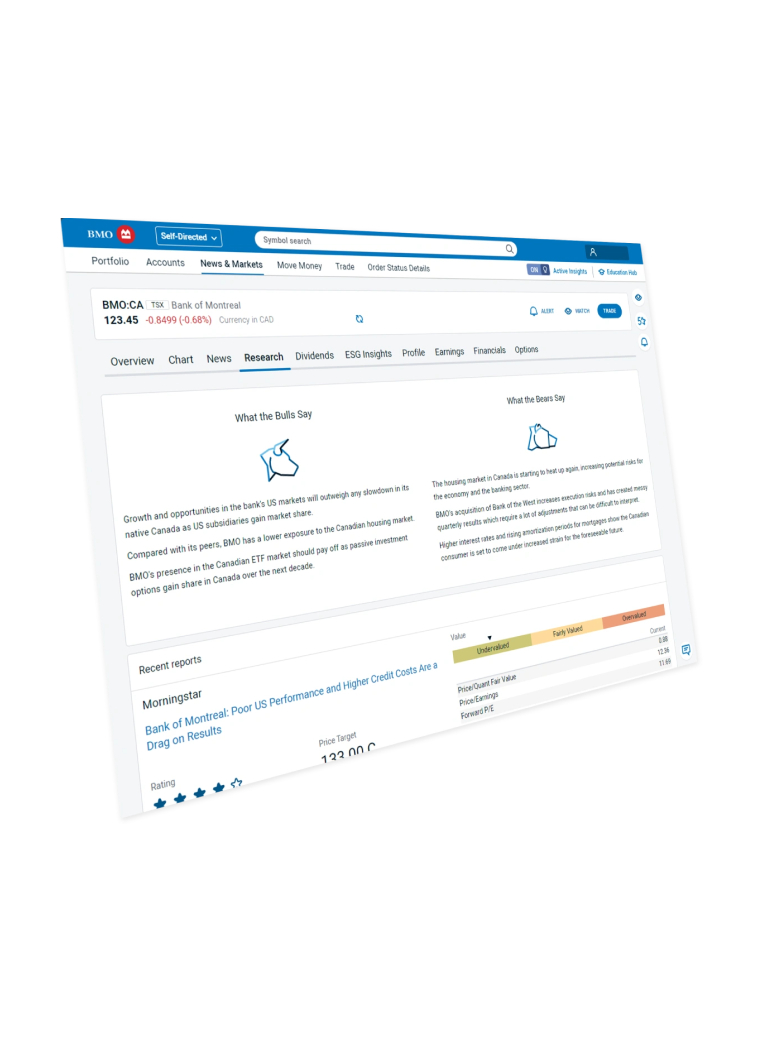

Market research

Get all of the information you need to stay informed on an ever-changing market with our research tools.

Proprietary and third party researchIn addition to BMO Capital Markets, we’ve partnered with leading research providers like Morningstar and S&P Global Ratings to give you reliable, independent perspectives on thousands of North American-listed companies.

Analyst RatingsLooking for third-party recommendations? Our Analyst Ratings feature captures ratings and target prices for Canadian and U.S. stocks, like the Lipper Fund rating for ETFs.

ScreenersScreeners let you filter different stocks, ETFs, mutual funds and fixed income securities based on a wide range of criteria. Use our enhanced screener and research tools to customize and streamline your results. Leverage pre-defined screeners, e.g., low fee, highly rated funds, etc, to help discover the right investments for you.

Watch listsOur redesigned watch lists allow you to retrieve a personalized list of current quotes with ease. Track the performance of up to 50 stocks, options or indices at a time.

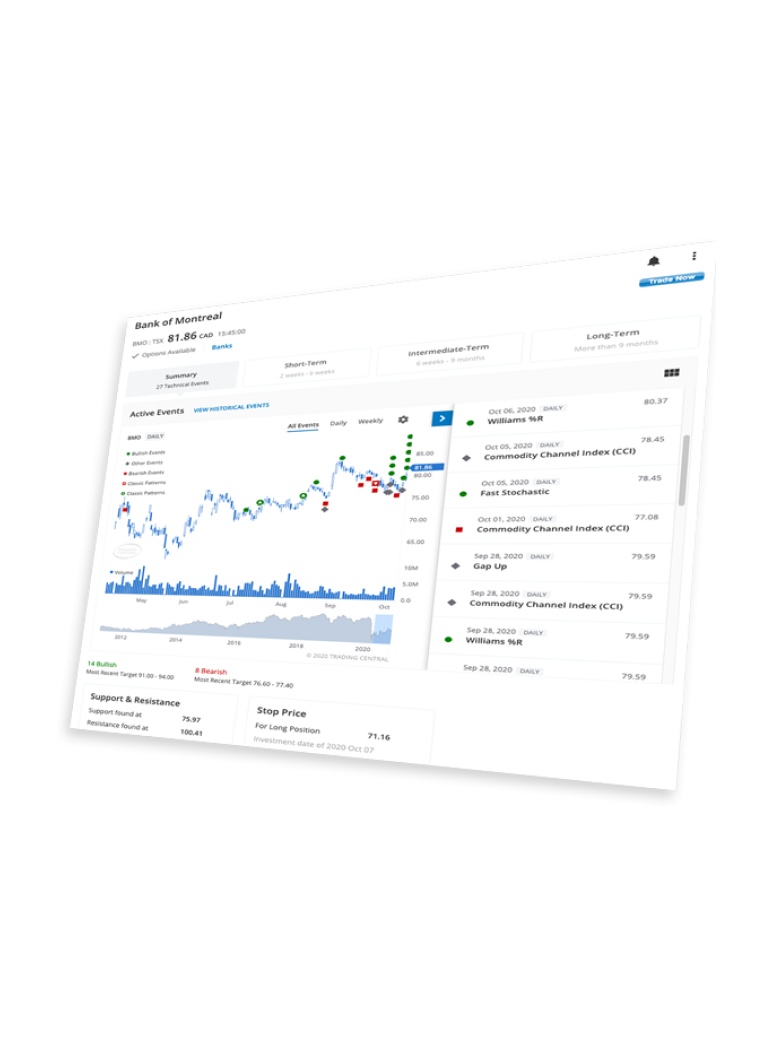

Fundamental analysis

It doesn’t matter if you’re a novice or a savvy, experienced trader – our analysis tools are here to help you dive deeper into the data and invest with confidence.

Our own tools are powered by Trading Central, an industry leading third-party trading tool, to let you deep dive into potential investments with insightful analytics.

Personalized InsightsGet dynamic insights on market events that are personalized to stocks or ETFs in your portfolio or watchlist. You can take advantage of new opportunities in real-time with insights on dividend announcements, earnings releases and distribution payments. These insights are ranked within your feed based on the weight of that security in your portfolio and importance of the event.

Value AnalyzerIdentify undervalued stocks and evaluate their potential with our rich, graphic tool, and become proficient in value investing – a popular investing style used worldwide.

Technical InsightAccess a universe of unbiased trade ideas based on emerging technical events. This valuable technical analysis tool lets you find, research and analyze new equity opportunities.

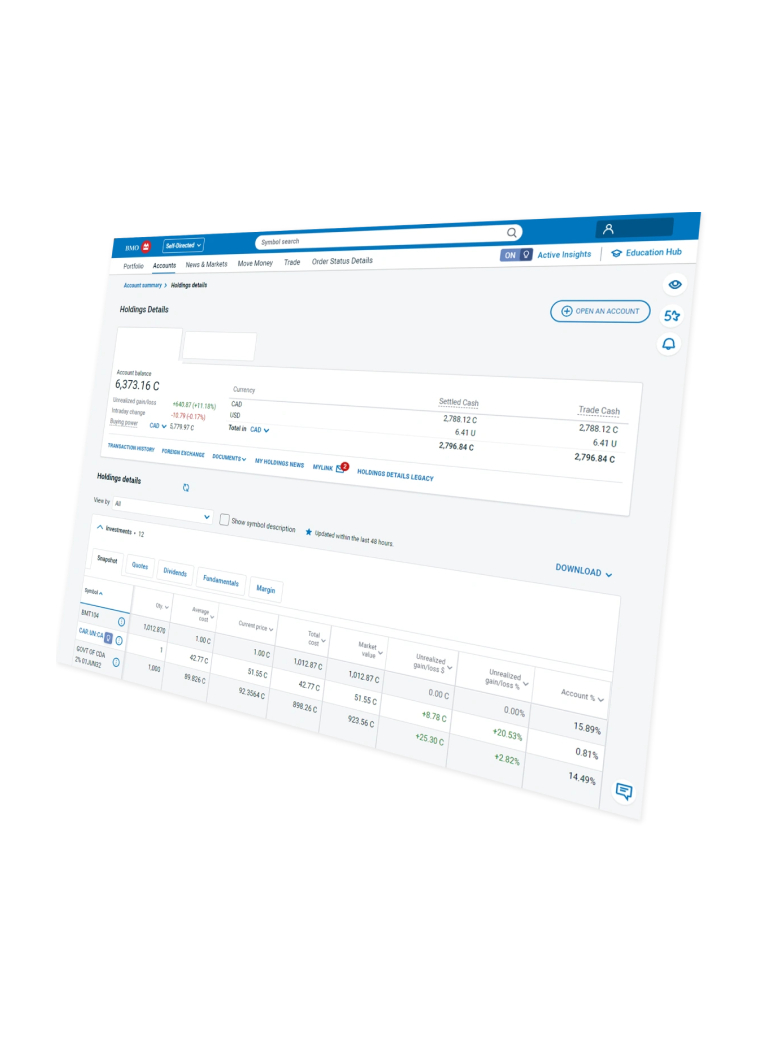

Tracking

Once your trades are made, our platform has the tools to track your performance. You can even do it from your smartphone!

Benchmark comparisons: Compare your portfolio’s performance to nine key indexes in four different time frames.

Mobile-friendly: Make trades and stay on top of your activity from your smartphone.

Customize your charts: Draw trend lines and then save your chart settings for faster future reference.

Receive mobile and email updates: Act fast on opportunities with updates on the stocks you’re following, along with daily or weekly performance summaries. Get email notifications whenever an equity and/or option order has been filled.

Experienced trader? Elevate your trading with BMO’s 5-Star Program

Tailored for seasoned traders, our program offers exclusive tools, and dedicated support for those with 15+ trades per quarter or over $250,000 in investments.

Preferred rates and pricing

- Professional-level tools, like BMO Active Trader

- Industry-leading research

- Dedicated 5-star support