Welcome offer

25,000 bonus points for you

Get rewarded when it comes to building your financial future.

25,000 bonus points for you

Earn more (a lot more) on your daily needs and wants.

Streaming services, a gym membership or a cellphone bill – earn points on all of it as you go about your day. GetFive timesthe points for every $2 spent on recurring bill payments.92

You need to eat, so why not get rewarded at the same time? GetFive timesthe points for every $2 spent on groceries.92

You’ve got great taste! EarnFive timesthe points for every $2 spent on dining out at your favourite restaurant.92

What’s better than getting your favourite meal to go or delivered to your doorstep? GettingFive timesthe points for every $2 spent on it!92

Plus, earn 1 point for every $2 spent on everything else.93

Enjoy three months of Instacart+ and a $5 monthly Instacart credit when you enroll your eligible BMO Credit Card.121 Terms apply.

Recurring bill payments, groceries, dining and takeout (earn 5 times points for every $2 spent):

All other purchases (earn 1 point for every $2 spent):

Your first year B M O Rewards points total: 00

Protect your next adventure with BMO Travel Insurance

Although your credit card does not include travel insurance, we make it easy to travel confidently with our flexible travel coverage options.

Your card comes with the following embedded benefits:

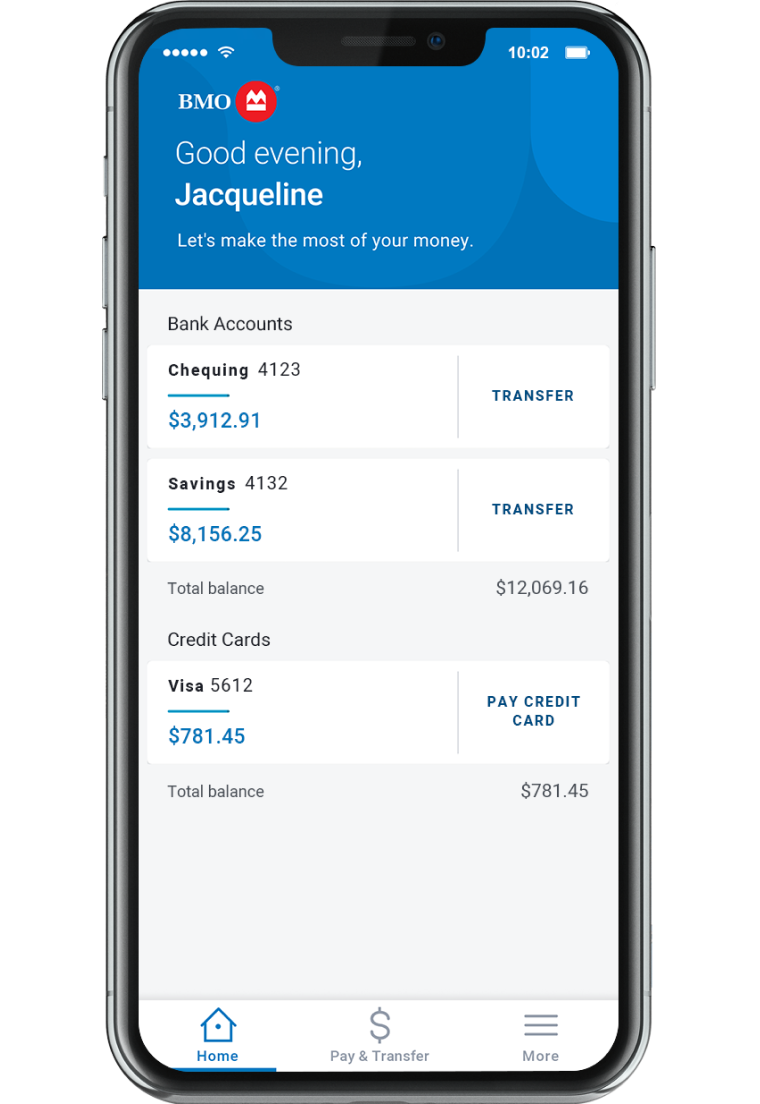

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Stay on top of your spending with a personalized look at your money.

Get free, 24/7 access to Credit Coach with no impact to your credit score.

Resolve an issue with your statement or reset your PIN directly from your mobile app.

Visit bmorewards.com to check out where your BMO Rewards points can take you or to browse our online merchandise catalogue and more.

You can pay with your Rewards points in three simple steps:

You’ll need to share a few things to open an account online, including your name, date of birth, contact info,Social insurance number, address, employment status, income source(s), and rent or mortgage amount. The better picture we have of your financial health, the faster we can let you know if your application has been approved.

There are a few requirements you need to meet to apply for a credit card with us:

Yes. We’re committed to protecting your confidential information and privacy and we continuously employ the latest security software to our sites and apps.

Additionally, our digital experiences have been upgraded with extended validation (EV) SSL Certificates, which add another layer of protection by identifying our sites and applications as legitimate.