Student borrowing

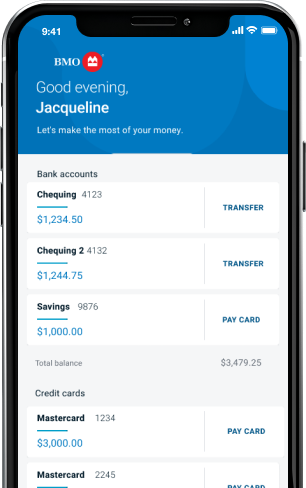

A student line of credit is a flexible, affordable way to pay for school. Here’s how:

Easily access cash to help cover tuition, rent, books, etc.

Get a competitive interest rate with no annual or monthly fees

Make interest-only payments while you’re in school, plus two years after graduation

Browse your line of credit options

Complete your post-graduate degree (e.g. law, pharmacy, MBA) with the help of flexible financing and customized credit limits.

Limited-time offer: Earn a $500 cash bonus* when you open a BMO Professional Student Line of Credit.

The details:

A range of credit limits available based on your program of study to help you meet your borrowing needs

Low interest rate based on BMO’s Prime Rate plus 1% while you’re in school2

Designed with medical and dental programs in mind, these lines of credit feature enhanced credit limits.

Limited-time offer: Earn a $500 cash bonus* when you open a BMO Medical or Dental Student Line of Credit.

The details:

Borrow up to $350,0001 depending on your program

Low interest rate based on BMO’s Prime Rate minus 0.25% while you’re in school2

Student line of credit Frequently asked questions

Student loans are only offered by the federal or provincial governments. A bank can also offer you a personal loan to use for school expenses. With a loan, you pay interest on the full amount you are given.

A student line of credit from a bank gives you access to a set amount of money you can borrow as needed – and you’re only charged interest on what you borrow. For example, if you have a $15,000 line of credit and only borrow $5,000, you’re only charged interest on the $5,000.

Interest is calculated on your daily balance and charged monthly to your account.

Yes, they can – and it’s good to keep this in mind. For lines of credit, your interest rate is a variable interest rate and will change without advance notice whenever BMO's Prime Rate changes or otherwise with notice in accordance with the terms of your Student Line of Credit agreement.

The BMO Prime Rate – also known as the prime lending rate – is the annual rate we use to set variable interest rates for our loans, lines of credit and mortgages. The actual rate you’ll get on your loan or line of credit is based on many factors in addition to the Prime Rate. These include how much you’re borrowing, your credit history and if you’re using collateral. You can see our current Prime Rate here.

If you stay in school beyond your expected graduation date, we may ask you to provide proof of continued enrolment to keep your Student Line of Credit active. Just book an appointment and bring along a supporting document that shows you’re currently enrolled in a full-time post-secondary program. Have questions? Feel free to contact us and we can help.

Helpful lending tips and advice

Footnote dagger details Contingent upon the account being in good standing and the customer abiding by all applicable policies and procedures as per the product agreement

Star Terms and conditions apply. Click here to view full offer details.

Footnote 1 details Approval and credit limit are subject to meeting BMO's usual credit requirements. Must be a Canadian citizen or Permanent Resident enrolled in a Canadian or non-Canadian post-secondary school or university. Co-signer may be required. Subject to credit availability and verification of identity. Borrowing limits and repayment time are determined by the type of program.

Footnote 2 details While you are attending the academic program identified in connection with your Student Line of Credit Agreement (the “Agreement”), your interest rate will only change with a change to the Prime Rate. After graduation, your interest rate may change in accordance with the terms of the Agreement.