Understanding the impact of changing interest rates

What causes interest rates to change?

Interest rates are influenced by factors such as inflation and overall economic activity. The Bank of Canada's interest rate decisions primarily impact variable rate mortgages, while fixed rate mortgages are influenced by the bond market, which reflects long-term interest rate trends.

How do changing interest rates affect my variable rate mortgage?

If you’re a homeowner with a BMO variable rate mortgage, you’ll notice that your mortgage payment stays the same1 and won’t change if the BMO prime rate changes.

The interest rate on your mortgage will fluctuate with the BMO prime rate throughout your term. So, when it increases, the variable rate on your mortgage will also rise. When it decreases, the variable rate on your mortgage will also decrease.

Here’s what that means for you:

As the variable rate decreases, more of your mortgage payment goes towards principal and less towards the interest portion of your mortgage balance.

With more of your payment going towards principal, your amortization period may decrease over time, which means you may pay off your mortgage balance faster than you originally planned.

As the variable rate rises, more of your mortgage payment goes towards the interest and less to the principal portion of your mortgage balance.

With less of your payment going towards principal, your amortization period may increase, which means it’ll take longer to pay off your mortgage balance than originally planned.

Your mortgage payments may increase when it comes time for renewal due to the rising prime rate.

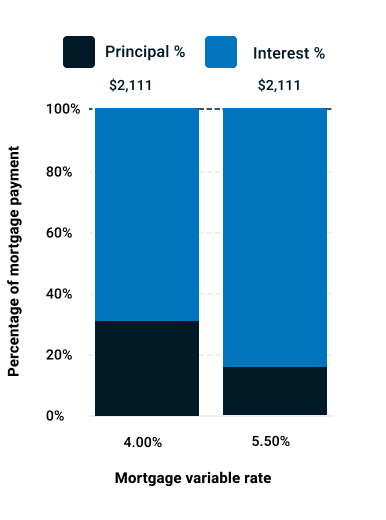

Impacts to monthly payments on a BMO variable rate mortgage2 as interest rates increase:

Here’s what monthly payments look like with a $400,000 variable rate mortgage with BMO.

When BMO prime rate increases from 4.00% to 5.50%, your monthly payment will remain at $2,111. In that case, where your money is going changes. A higher proportion of your payment will go towards interest compared to the principal of the mortgage.*

The bar graph illustrates how a change in interest rate will impact your mortgage payment. With a variable rate of 4.00%, you’ll contribute almost 40% toward your principal. With a rate of 5.50%, the portion applied towards your principal decreases to less than 20%. If no prepayments are made, the projected amortization may extend from 25 years to more than 36 years.

*For illustrative purposes only. The example assumes the mortgage interest rate is equal to the BMO Prime Rate.

When interest rates rise: what is a trigger rate?

A trigger rate is the rate at which your scheduled payments no longer cover the interest charges being applied to your mortgage balance. If interest rates rise, you may hit your trigger rate. Hitting your trigger rate means that your mortgage balance will increase with each scheduled payment instead of decreasing. This is also known as negative amortization.

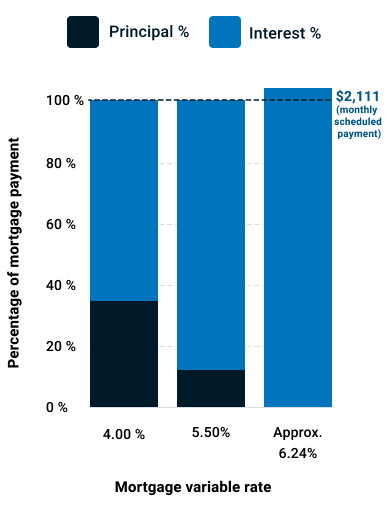

Example of hitting the trigger rate on a variable rate mortgage3

Let’s review what happens when you hit your trigger rate. To illustrate, we’ll use our example of the $400,000 variable rate mortgage with BMO that has a monthly payment of $2,111.*

When the variable rate increases from 4.00% to 5.50%, the portion of your monthly payments dedicated to the principal decreases. When the variable rate rises to approximately 6.24%, which is the point of the "trigger rate", your monthly payment no longer contributes to the principal.*

Beyond the point of this trigger rate, your monthly payment will no longer cover the interest portion of the mortgage balance. As a result, the mortgage balance will increase instead of decrease with each monthly payment.

*For illustrative purposes only. This example assumes the mortgage interest rate is equal to the BMO Prime Rate and that no prepayments have been made.

In the event you hit your trigger rate, we will notify you and provide options to bring your BMO mortgage back on track.

How do higher interest rates affect my mortgage at renewal?

Whether you have a fixed or variable rate mortgage, you may face increased mortgage payments at renewal if your new interest rate is higher than your current one and if your amortization period has increased.7

Here’s what you can do to reduce the impact of potentially higher scheduled payments at renewal, whether that’s today or a few years from now.

Make a lump-sum payment4Take advantage of our market leading lump-sum prepayment option of up to 20% towards your principal a year.

Increase your payments4Increase your regular payments by up to 20% once per calendar year.

Increase your payment frequencySwitching from monthly mortgage payments to an accelerated weekly or bi-weekly schedule can save you thousands and help you become mortgage-free faster.

Convert to a fixed-rate mortgageYou can switch to a fixed-rate mortgage and lock in a preferred rate while adding more stability into your monthly budget.

Make a lump-sum payment4Take advantage of our market leading lump-sum prepayment option of up to 20% towards your principal a year.

Increase your payments4Increase your regular payments by up to 20% once per calendar year.

Increase your payment frequencySwitching from monthly mortgage payments to an accelerated weekly or bi-weekly schedule can save you thousands and help you become mortgage-free faster.

Follow along with our demo to learn how you can make extra mortgage payments on BMO Online Banking.

Frequently asked questions

If you have a fixed rate mortgage, you won’t feel the effects of changing interest rates unless it’s time for renewal. Your mortgage interest rate will remain locked in for the entire duration of your mortgage term, meaning that your payments will remain the same and you’re on a set amortization schedule.

Interest rates are influenced by factors such as inflation and economic activity. The Bank of Canada's interest rate decisions primarily impact variable rate mortgages, while fixed rate mortgages are tied to the bond market, which reflects long-term interest rate trends.

Inflation and interest rates go hand-in-hand. When there’s strong consumer spending in the economy, inflation naturally rises. When it goes above the Bank of Canada’s target, they may raise the key policy interest rate in response. The most immediate effects can be seen in rising mortgage rates.

Interest rates rise in response to inflation to help cool the market. The Bank of Canada does this as a safety measure to keep the economy running smoothly and to counter rising inflation. While this does increase the cost of borrowing money, people are likely to spend less, which can ease demand for goods and theoretically drive prices back down.

The interest rate for a variable rate mortgage fluctuates depending on market conditions, which can affect how much of your payment goes toward principal. When variable rates rise, you’ll find that more of your payments go towards interest. As the Bank of Canada works to curb inflation, those with variable rate mortgages may experience frequent changes.

The Bank of Canada publishes their interest rate announcement schedule on an annual basis.

If you’re having difficulties making your mortgage payment because of rising interest rates, we’d like to help. Contact us and we’ll be happy to discuss potential mortgage deferral options with you.

With refinancing, you can borrow additional funds to help finance your big plans. A blend refinance option allows you as a homeowner in a competitively lower fixed rate mortgage to borrow additional funds at current mortgage rates without breaking your existing mortgage term or incurring prepayment charges.6

Helpful mortgage resources

Footnote 1 Please note, this may vary in certain situations. In accordance with your loan agreement, action may be required if the scheduled mortgage or instalment payment is no longer sufficient to cover the interest charges being applied. If the mortgage or instalment payments remain unchanged, there may be implications to your principal and interest payments at the time of renewal. For more information, please see your loan agreement.

Footnote 2 The graph is an example of monthly payments on a variable rate mortgage with a principal amount of $400,000 and a 25-year amortization. Source: BMO online mortgage calculator.

Footnote 3 The graph is an example of hitting the trigger rate on a variable rate mortgage with a principal amount of $400,000, a 25-year amortization, a mortgage variable rate at origination of 4%, and no prepayments. The trigger rate presented in this example is for illustrative purposes only. Actual trigger rates may vary based on individual mortgage terms, market conditions, and changes to the prime rate. Source: BMO online mortgage calculator.

Footnote 4 Accelerated payment details vary for a BMO Smart Fixed Mortgage, please consult your lending agreement(s) or contact a BMO representative.

Footnote 5 Allows homeowners to transfer the existing terms of their fixed rate closed mortgage or Homeowner ReadiLine® fixed rate closed installment to a new mortgage of the same type.

Footnote 6 Subject to meeting BMO’s standard lending criteria. Appraisal and other fees may apply.

Footnote 7 Please note that prepayment charges may be affected by changes in the posted rate for both variable-rate and fixed-rate mortgages. For more information, please visit our BMO prepayment calculator or mortgage prepayment options.