BMO CashBack® Mastercard®*

Enjoy the most cash back on groceries in Canada without paying an annual fee*

* Based on a comparison of the non-promotional grocery rewards earn rates on cash back credit cards with no annual fee and no bank account balance requirement as of August 01, 2025.

Cashing in on your cash back

Your cash back rewards never expire as long as your account is open and in good standing

No waiting! Redeem your cash back any time you want for as little as $1

Set up an automatic deposit whenever you reach a certain amount, starting at $25

Enjoy the flexibility to put your cash back where you want:

- Statement credit

- BMO chequing or savings account

- InvestorLine

Save on groceries and more with complimentary Instacart+

Enjoy three months of Instacart+ and a $5 monthly Instacart credit when you enroll your eligible BMO Credit Card.121 Terms apply.

BMO CashBack® calculator

Estimate your monthly spending

Groceries (3% cash back) Footnote 2C

Recurring bill payments (1% cash back) Footnote 2B, Footnote D, Footnote E

Other spending: (0.5% cash back) Footnote 2E

Estimated yearly rewards

Total cash back in your first year 0

Including up to 5% cash back on every purchase in your first 3 months.‡‡

Redeem your cash back whenever you want, or simply set up recurring deposits and get rewarded automatically.51

Deposit it into your BMO chequing or savings account

Put it into your InvestorLine account

Use it as a credit on your monthly statement

Digital features and security at your fingertips

Give your financial health a boost with online and mobile banking tools. Enjoy more control over your credit card and a better understanding about how you’re using it.

Safety and security

Can’t find your card? No worries, you can lock it, unlock it or report it lost or stolen at any time.

Financial insights

Stay on top of your spending with a personalized look at your money.

Credit Score

Get free, 24/7 access to Credit Coach with no impact to your credit score.

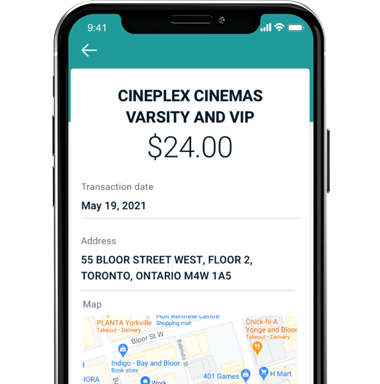

Detailed transaction view

Get a detailed view of when and where you made your purchases on the BMO mobile app.

Ready to apply?

Start earning and redeeming cash back now.

We'll respond in under 60 seconds.

Protect your next adventure with BMO Travel Insurance

Although your credit card does not include travel insurance, we make it easy to travel confidently with our flexible travel coverage options.

Single Trip Plans: Ideal for one-time vacations or quick business trips. Get coverage for emergency medical expenses, trip cancellations, baggage loss and more.

Multi-Trip Plans: Perfect for frequent travellers. Enjoy year-round protection for unlimited trips within your chosen coverage period.

Extended Warranty InsuranceDoubles the original manufacturer’s warranty period on items purchased up to a maximum of one year when you charge the full purchase price to your card.97

Purchase Security InsuranceCovered items purchased in full with your card are automatically insured against theft or damage for the first 90 days from date of purchase.97

Credit Card Balance ProtectionEnrol in the Credit Card Balance Protection plan and receive up to $20,000 credit card balance coverage.

Check out these other options you can add on:

Roadside assistance

Zero LiabilitySafeguard yourself from any monetary loss resulting from fraudulent card use.

BMO AlertsManage notifications for credit card transactions, large purchases, international use and more via BMO Digital Banking or BMO Mobile Banking.

Mastercard Identity CheckAdd another layer of security to protect you when you shop online.

Car Rental DiscountSave up to 20% on National Car Rental®†† and Alamo Rent A Car®††and up to 5% on Enterprise Rent-A-Car®†† at locations worldwide using the Car Rental Booking tool.25

Cirque Du Soleil Discount Get 20% off admission to Cirque du Soleil shows touring Canada48, and 15% off resident shows in Las Vegas.49

Add Another Cardholder For FreeEarn even more cash back when you add another cardholder, free of charge.8

BMO PaySmart™ Installment Plans

Live now, pay smarter with a BMO PaySmart plan by turning your credit card purchases into smaller, monthly payments at a low cost.

Frequently asked questions

When you make a purchase at a grocery store or supermarket that sells a complete line of food products (think vegetables, ice cream and everything in between), you can earn 3% cash back up to a limit of $500 spent for a given statement period.2C

Convenience stores, general merchandise stores, bakeries, butchers and other speciality shops are excluded from this offer (those purchases will earn the base rate of 0.5% cash back).

Recurring (or ongoing) bill payments are made on a regular basis – your monthly Internet bill, for example. The merchant (in this example, your Internet service provider) automatically bills your card each month. This sort of automatic bill payment made with your BMO® CashBack® Mastercard®* may be eligible for 1% cash back (0.5% base rate, plus 0.5% bonus up to $500 spent for each statement period).2D

Not all merchants offer recurring payments, and not every recurring bill payment will earn the bonus cash back, so check with your providers to find out how they are processing your bill payment.

It’s easy! There are three simple ways to see how much you’ve earned:

Log in to the www.bmocashback.com

or

Check your cash back balance on your monthly BMO credit card statement.

or

Check your cash back balance when you log in to BMO Online Banking or the BMO Mobile Banking app.

To help you keep tabs on your cash back activity, your Online Statement shows you how much you’ve earned, up to the billing date. Any cash back earned after the billing date will be included in your next month’s statement.

- You can redeem your cash back for as little as $1 by visiting www.bmocashback.com. You can also setup recurring redemptions for as little as $25. You have the option to redeem your cash back right into your BMO chequing or savings account, or as a statement credit on your BMO CashBack Mastercard.

- To get direct deposits, you’ll need a BMO chequing, savings or InvestorLine account.

You’ll need to share a few things to open an account online, including your name, date of birth, contact info, SIN, address, employment status, income source(s), and rent or mortgage amount. The better picture we have of your financial health, the faster we can let you know if your application has been approved.

There are a few requirements you need to meet to apply for a credit card with us.

- Be a Canadian citizen or permanent resident

- Have not declared bankruptcy in the past seven years

- Have reached the age of majority in the province in which you live (18 years in AB, MB, ON, PE, QC and SK. 19 years in all other provinces)

- Meet minimum income requirements

Yes. We’re committed to protecting your confidential information and privacy and we continuously employ the latest security software to our sites and apps.

Additionally, our digital experiences have been upgraded with extended validation (EV) SSL Certificates, which add another layer of protection by identifying our sites and applications as legitimate.

If you have an emergency at home or away, you can contact the Mastercard Assistance Centre 24 hours a day: 1-800-247-4623 (within Canada and the U.S.)

1-314-275-6690 (outside North America, call collect)

- Yes, you can! You’ll be able to set up, manage and review your PaySmart installment plans from your Online Banking account.

To get started, simply login and follow these steps for recent eligible credit card purchases of $100 or more:

- Choose an eligible credit card purchase you’d like to convert into a PaySmart plan.

- Go to the Installment Plan tab and click the Create button.

- Select the plan that works best for you.