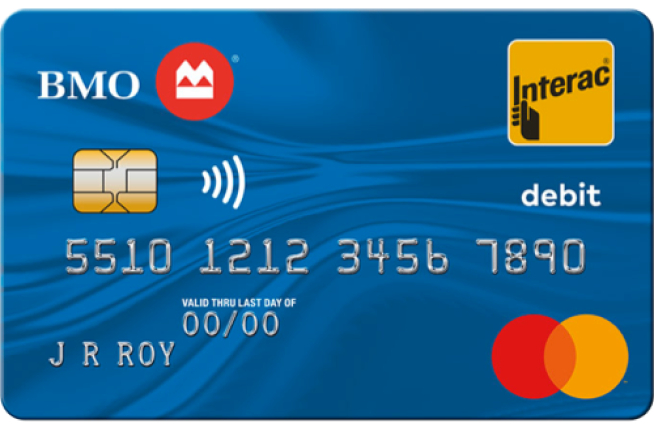

Shop securely online and in store with your BMO Debit Card

BMO Debit Cards with the Mastercard® footnote star and INTERAC® footnote double dagger logos on it let you:

Shop online at Canadian and international retailers

Make in-app purchases through your mobile wallet

Tap in store for purchases in Canada up to $250 using INTERAC Flash® footnote double dagger

Pay for public transit without affecting your monthly debit transaction count limit

Don’t have the Mastercard and INTERAC logos on your BMO Debit Card? Upgrade it today to experience all the benefits.

Enjoy exclusive perks at Cirque du Soleil

Get discounts on tickets, access to Mastercard VIP experiences and premium seats, a dedicated line at concession stands, and more.1

Don’t have the Mastercard and INTERAC logos on your BMO Debit Card? Upgrade it today to experience all the benefits.

What is a debit card?

A debit card is a way to access the funds in your bank accounts, which are generally linked to either your chequing or savings accounts. You can use a debit card to make purchases in store and online, and to withdraw cash from an ATM. If a debit card has the Mastercard symbol, it can be used on any international website where Mastercard is accepted.Footnote 2,Footnote 3 So while it’s not a credit card, it can be used like one for international and online purchases.

How to Use & Manage

Shop your way with your BMO Debit Card

Online purchases

Use your debit card to pay for online purchases up to $3,000 from Canadian retailers who accept Debit Mastercard

Make INTERAC in-app purchases at select merchants, where available

All online and in-app purchases made with your BMO Debit Card come directly out of your primary bank account

In store with INTERAC Flash

INTERAC Flash, a feature of your debit card, allows you to:

Make contactless payments of up to $250 in Canada for a faster checkout experience with your card

Tap your mobile device to make purchases once your card is loaded to your mobile wallet

All INTERAC Flash purchases come directly out of your primary bank account

Internationally with Debit Mastercard

Make international purchases at any international vendors who accept Mastercard

When prompted to make an international purchase, select Credit instead of Debit and then enter your PIN or sign the purchase receipt

All international purchases made with your BMO Debit Card will come directly out of your primary bank account

Manage your card online

Report your debit card as lost or stolen

If you think your debit card has been lost or stolen, you can let us know and request a replacement online.

Lock and unlock your debit card

Misplaced your debit card? Lock it online immediately to pause any transactions made with it and unlock it when you’re ready.

Change your debit card PIN

Simply choose a new PIN online and activate it by making a financial transaction at a BMO or non-BMO ATM.Footnote 4

Get detailed debit transactions

Select an in store purchase and review transactions that include full merchant details and location of purchase on Google Maps™.

BMO Debit Card Frequently asked questions

You can quickly report your debit card as lost or stolen and request a new card through the BMO Mobile Banking app or BMO Online Banking. Just follow these steps:

- Sign into Mobile/Online Banking

- Select your bank account and then ‘Manage Card’ on the account details page

- Select the ‘It’s lost or stolen’ option

- Review your information and submit

A new debit card will arrive in the mail in 6 to 8 business days. You can also visit your nearest branch or contact us.

Your debit card has no annual fee. Fees may apply for purchases made in another country, or remote purchases made with a foreign merchant from the United States. If you use your debit card at another financial institution’s ATM, a fee may apply.

It’s a debit card. Purchases from merchants within Canada are processed through INTERAC Debit or INTERAC Flash.

However, the Mastercard logo means your BMO Debit Card is accepted internationally anywhere Mastercard is accepted in-store (including the United States). It is also accepted online at Canadian merchants that accept Debit Mastercard and international merchants that accept Mastercard.

All purchases made with the BMO Debit Card are paid directly from your BMO bank account.

You will receive a new BMO Debit Card when your existing BMO Debit Card needs to be replaced. However, if you want a new BMO Debit Card sooner or need a replacement, visit any BMO branch or contact us.

When using your BMO Debit Card online, you’ll pay in Canadian dollars. The currency exchange rate charged for purchases made with international merchants is the rate charged by Mastercard International on the date the transaction is posted to your account.

U.S. dollar transactions will be converted to Canadian dollars based on the current foreign exchange rate and will include an additional mark up of 2.5%. The mark-up will be included in the exchange rate posted to your account.

For foreign currencies other than U.S. dollars, the transaction amount will be converted first to U.S. dollars by Mastercard International, then to Canadian dollars.

Some transactions are not debited from my account immediately – why?

Depending on how the merchant is set up, for some transactions we may place a hold for up to seven (7) business days on your account in the amount of your purchase in Canadian dollars. The hold will be removed when the transaction is debited from your bank account, or when the hold expires, whichever occurs first.

In some cases, the merchant has 30 business days to complete a transaction. This can lead to a delay in seeing the debit applied to your account, or the hold could be removed before the merchant debits your account. Even though the hold has been removed, you are still liable for the purchase when the merchant submits it for processing. Some merchants may process the transaction right away and, in these instances, a hold is not applied to your account.

Which account will be used when I make an INTERAC Flash, INTERAC in-app or online purchase?

When you make an online, INTERAC Flash or in-app purchase the amount will automatically come out of your primary account which is also known as the account in the chequing position. You are unable to select the account you want to use, therefore, you should ensure that you have enough money in your account to cover the purchase to avoid non-sufficient fund fees or a declined transaction.

What types of transactions have enhanced transaction details?

The enhanced transaction details feature only applies to in-store purchases. It doesn’t apply to online, in-app purchases, pre-authorized debits or ATM withdrawals.

What do I do if I don’t recognize one of my transactions?

If you discover something that doesn’t seem to add up, you can contact the merchant associated with that transaction. Their contact information should be available in the enhanced transaction details.

There’s information missing on the enhanced transaction details. Why isn’t it there?

When this happens, it could be because the merchant that you’ve bought something from hasn’t shared their information with us. You’ll see a message saying, “this business hasn’t shared this data”.

If I use my debit card to pay for transit, will it count toward my monthly debit transaction count?

Any fare payments made with your INTERAC debit card at any Canadian public transit authorities won’t count toward your transactions count limit, whether you tap your card or mobile wallet at a fare reader.

Ready to use your debit card? Here are some other things to try

Registered sign Footnote star details Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Used under license.

Registered sign Footnote double dagger details INTERAC e-Transfer is a registered trademark of Interac Inc. Used under license.

Cirque du Soleil, Cirque du Soleil Crystal, Cirque du Soleil ECHO, Corteo, TOTEM, KURIOS, KOOZA, OVO, Alegría, ‘’O’’, KÀ, Mystère, Michael Jackson ONE and Mad Apple are trademarks owned by Cirque du Soleil and used under licence.

Google Maps is a trademark of Google LLC.

Footnote 1 details Ticket offers, preferred seating and discounts subject to availability. Some exclusions, terms and conditions apply.

Footnote 2 details For purchases made through the Mastercard network, a 5-business day hold may be put on your bank account in the amount of your purchase in Canadian dollars. The hold will be removed when the transaction is debited from your bank account or after the 5 business days have passed, whichever occurs first.

Footnote 3 details The exchange rate for converting foreign currency transactions to Canadian dollars is the rate charged to us by Mastercard International on the date the transaction is posted to your account, plus 2.5% for purchases and minus 2.5% for refunds. For foreign currency transactions other than U.S. dollars, the amount is first converted to U.S. dollars and then to Canadian dollars.

Footnote 4 details Non-BMO ATMs in Canada and ATM’s outside of Canada may charge a convenience fee.