How to deposit money online

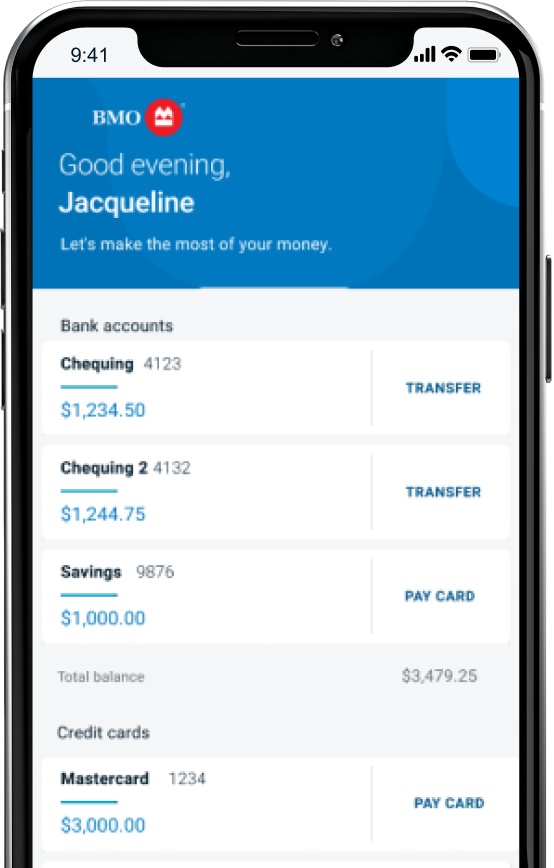

Deposit cheques instantly using the BMO Mobile Banking App, set up direct deposit in Online Banking or visit an ATM to deposit a cheque envelope-free.

How are you depositing money?

Find out how to deposit money quickly and easily using your mobile device, on your computer or at an ATM.

Deposit up to $25,000 footnote star instantly with Interac e-Transfer®

Ditch the security questions and get your money faster. Register for Autodeposit and you can receive money through Interac e-Transfer automatically – no need to sign into your account or answer a security question.

Here’s how to set up Autodeposit in minutes through the BMO mobile app:

- Sign into the BMO Mobile Banking App.

- Select More from the main menu, then select INTERAC e-Transfer®.

- Select Manage Autodeposit then enter your email address and pick your deposit account.

If you’re receiving money from someone you trust, you can give them your account number to deposit the Interac e-Transfer in your BMO account directly, without registering for Autodeposit footnote star, star. No security question required!

Deposit money F A Q s

No, you can only deposit money to your BMO accounts at a BMO ATM.

When you make a deposit at an ATM or branch, that money can be held up to eight business days (not including the day of the transaction) depending on the amount and how you made the deposit. And if a foreign currency cheque has been deposited, the funds may be held up to 30 business days.

When you deposit a cheque at an ATM or branch, $100 of the cheque amount may be available to you immediately. The rest of the funds will be available after the hold has expired, usually between four to eight business days. The hold period is determined by a variety of factors. After you deposit your cheque, you can go online to see how much of the funds are available to you.

Mobile cheque deposit lets you quickly and conveniently deposit cheques via the BMO Mobile Banking App by simply taking a picture of the front and back of the cheque using the camera on your phone.

You can deposit a cheque anytime, anywhere by using your BMO Mobile Banking App and following these simple steps:

- Sign in to your BMO Mobile Banking App.

- From the Pay & Transfer ($) menu or the More menu, select Deposit a Cheque.

- Enter the amount of the cheque.

- Select the account you want to deposit the cheque to.

- Take a picture of the front and the back of the cheque.

- Confirm deposit details.

Remember to endorse your cheque by signing your name and writing your full account number after quote, for deposit only, account number on the back of the cheque.

Write the date and "Deposited" on the front of the cheque. Keep it for 14 days to ensure it clears, then destroy the cheque promptly after the 14-day period and no later than 120 calendar days after the deposit date.

You can use mobile cheque deposit to deposit cheques, including certified cheques and travelers cheques, money orders, and bank drafts issued by a Canadian financial institution or the federal or provincial governments in Canada, in Canadian dollars, that are payable to you.

When you deposit a cheque through mobile cheque deposit, funds may be put on hold in accordance with your account agreement and the BMO cheque hold policy. Upon completing your deposit, if a hold is placed on your deposit, the hold amount and the date the funds will be available will appear in the success message.

There is no charge to deposit cheques into your personal deposit account. Per-item deposit content fees may apply when you deposit items into a business banking account.

No. You can only deposit cheques in Canadian currency issued by a Canadian financial institution, or the federal or provincial governments in Canada through mobile cheque deposit.

You cannot deposit a cheque with online banking, but you easily can at a BMO ATM or branch.

Feeling good about depositing money? Here are some other things to try

- Footnote double dagger details Interac e-Transfer® is a registered trademark of Interac Inc. Used under license.

- Footnote star details The daily, weekly and monthly rolling limits no longer apply for incoming e-Transfer payments. Receive e-transfer payments of up to $25,000 at a time as long as the sender’s bank allows limits that high.

- Footnote star, star details Subject to the sender’s bank having these capabilities enabled.