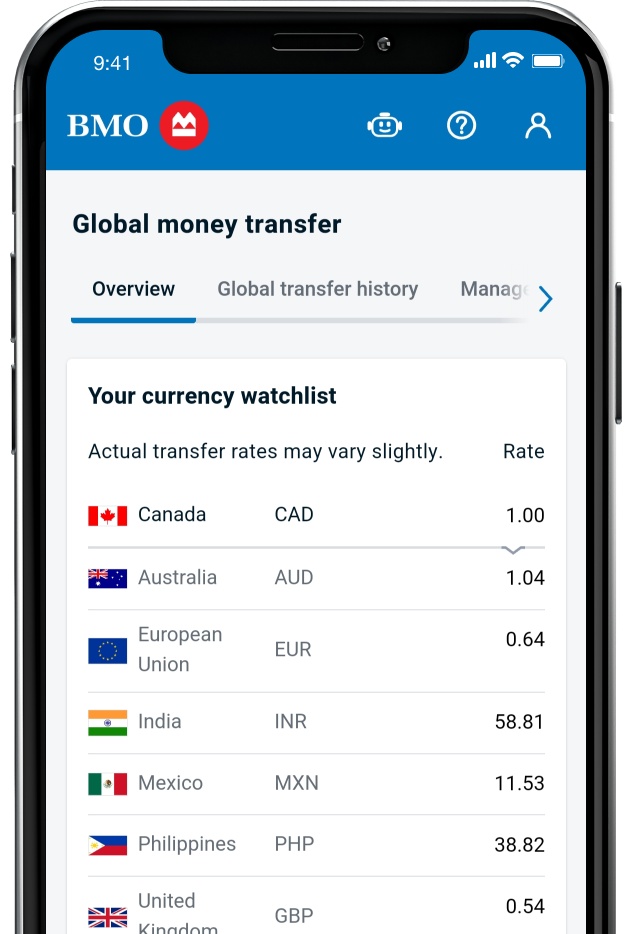

Get real-time rates

Check exchange rates in real time, so you know your rate before sending a transfer.

Send money overseas quickly and securely with BMO Global Money Transfer. Say goodbye to high fees and complicated transfers, and send money to nearly 70 destinations*103 through the BMO Mobile Banking app and BMO Online Banking.

Transfer money any time, from anywhere life takes you.

Check exchange rates in real time, so you know your rate before sending a transfer.

Sending money to the same person is a breeze with the Send Again feature.

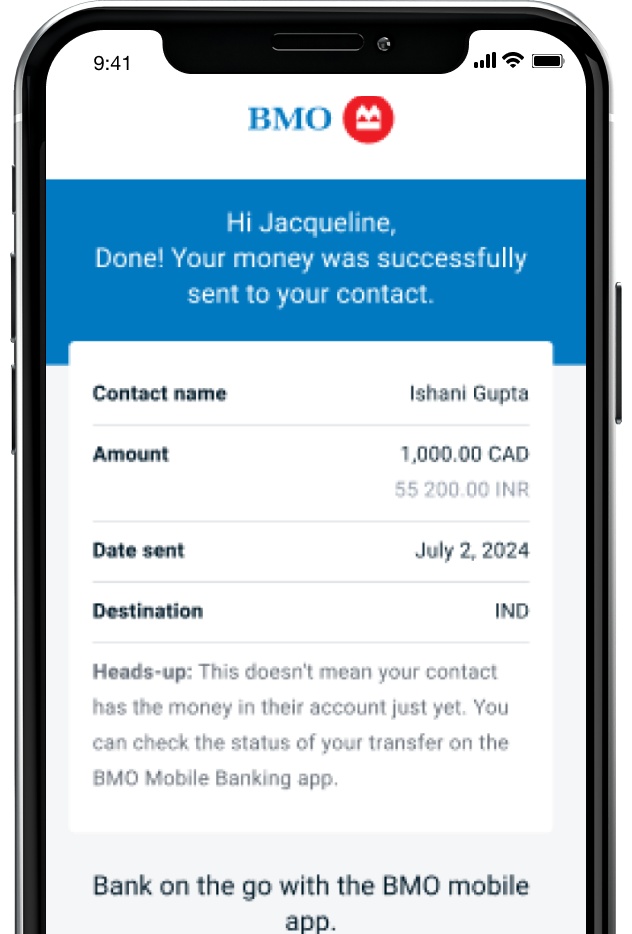

With real-time notifications, you’ll know exactly when your transfer arrives.

Easily transfer money abroad in two to five business days with BMO Global Money Transfer.*97 Discover how simple it is.

Open an account today and enjoy all the benefits of BMO Global Money Transfer.

You can call the number on the back of your BMO Debit Card, visit a branch, or contact your BMO Relationship Manager to have the service turned on in BMO Online Banking and on the BMO Mobile Banking app.

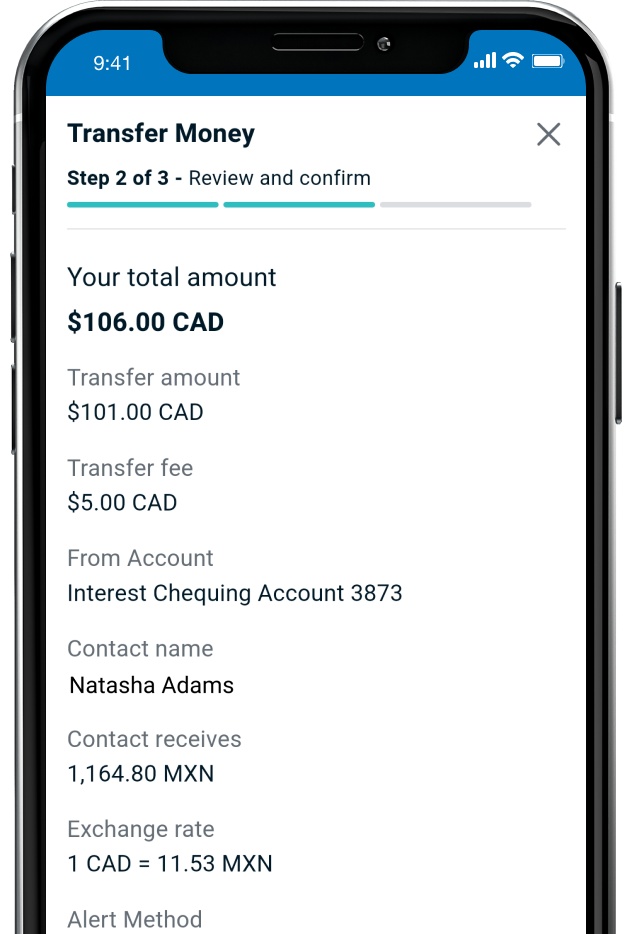

You’ll pay a $5 flat fee per transaction. If you’re transferring money from a U.S. dollar account, the $5 fee will be charged in U.S. dollars.

We’ll always waive the $5 service fee if the transfer is to BMO in the United States, or if you have one of the following bank plans:

The recipient won’t be charged by BMO for the transfer, but some financial institutions may charge their own fees for the wire transfer. Recipients can confirm any fees with their financial institution.

Note: Standard foreign exchanges rates apply. BMO Global Money Transfer transactions count towards the monthly transaction limit included in your bank plan.

The minimum transfer amount is C $100 and the maximum amount depends on your daily debit card limit.

You can check your daily limit for transfers in the BMO Mobile Banking app or BMO Online Banking.

You can send money from any of our Canadian dollar personal chequing and savings accounts.

If you’re sending money to the United States, you can also use a U.S. dollar personal chequing or savings account.

To send money abroad, you’ll need the following information from the recipient:

Note: Depending on the destination, some additional information about the recipient may be needed, like their phone number, address or government ID.

Typically, the money is deposited in the recipient’s bank account within 2 to 5 business days.*97

They’ll receive the transfer in their local currency. Some destinations may convert the money to a different currency, and fees could apply. The recipient can confirm the currency with their financial institution.

Yes! You can save their information in both BMO Online Banking and the BMO Mobile Banking app to speed up the process in the future. It’s still a good idea to confirm the information with the recipient before sending any transfers.

Checking the status of a transfer is simple. Here’s how to do it:

Here’s what the different status options mean:

Unfortunately, you can’t cancel a transaction once it’s been completed.